Yes, FreshBooks can help with taxes. It offers tools for tracking income, expenses, and deductions.

This makes tax preparation easier. Taxes can be stressful, but FreshBooks aims to simplify the process. This accounting software provides features that help manage your finances all year. By keeping track of your financial activity, it ensures you are ready when tax season arrives.

FreshBooks generates essential reports, so you know what you owe and what you can deduct. This blog will explore how FreshBooks supports tax preparation, making it less daunting. Read on to learn how this tool can assist you with your taxes, ensuring you stay organized and compliant.

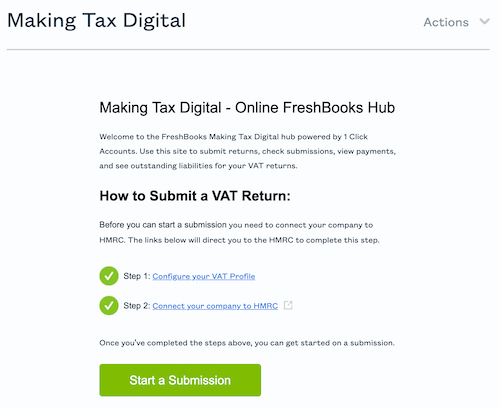

Credit: support.freshbooks.com

Introduction To Freshbooks

Freshbooks is a popular accounting software designed for small businesses. It helps manage invoicing, expenses, time tracking, and more. Many users wonder if Freshbooks can handle taxes. To understand this, let’s first explore what Freshbooks is and its key features.

What Is Freshbooks?

Freshbooks is cloud-based accounting software. It simplifies financial management for freelancers and small business owners. Users can create professional invoices and track expenses with ease. Freshbooks also offers time tracking and project management tools.

Key Features

Freshbooks offers several key features. These features make it a powerful tool for small businesses.

- Invoicing: Create and send professional invoices quickly.

- Expense Tracking: Track business expenses and categorize them.

- Time Tracking: Log hours worked for accurate billing.

- Project Management: Manage projects and collaborate with team members.

- Reports: Generate financial reports to gain insights into your business.

- Tax Management: Freshbooks helps with basic tax calculations and reporting.

Freshbooks is designed to simplify accounting tasks. It helps users focus on growing their business. With its user-friendly interface, anyone can manage their finances effortlessly.

Tax Capabilities

When discussing the tax capabilities of FreshBooks, it’s clear that this accounting software offers a range of features to simplify tax tasks. This section will delve into the specific tax functionalities that FreshBooks provides, ensuring your tax processes are smooth and efficient.

Tax Calculation

FreshBooks excels in tax calculation. The software automatically calculates taxes on your invoices and expenses. This feature ensures accurate tax amounts every time. You can set tax rates for different jurisdictions, making it easier to handle complex tax scenarios.

Here is a simple table to illustrate the tax calculation features:

| Feature | Description |

|---|---|

| Automatic Tax Calculation | Calculates taxes on invoices and expenses. |

| Custom Tax Rates | Supports various tax rates for different regions. |

| Inclusive/Exclusive Tax | Choose between tax-inclusive or tax-exclusive pricing. |

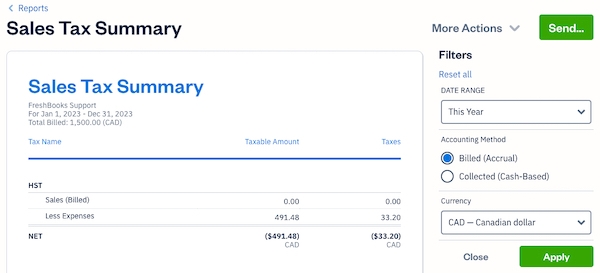

Tax Reporting

The tax reporting capabilities of FreshBooks are robust. The software generates comprehensive tax reports, which can be customized based on your needs. These reports help you track taxable income, deductions, and other tax-related information.

Some key tax reports include:

- Sales Tax Summary

- Expense Tax Summary

- Profit and Loss Statement

These reports are easy to generate and understand, providing a clear overview of your tax obligations.

User Experience

FreshBooks offers a seamless user experience for managing finances and taxes. Its intuitive design and helpful features make it a popular choice among small business owners and freelancers.

Ease Of Use

FreshBooks is known for its user-friendly interface. Setting up your account is quick and straightforward. The dashboard is clean and easy to navigate. You can easily find all the tools you need. The platform guides you through each step of managing your finances.

Creating and sending invoices is simple. You can track your expenses with ease. FreshBooks automatically organizes your income and expenses, making tax time less stressful.

Customer Support

FreshBooks offers excellent customer support. You can reach their support team through multiple channels. They provide phone, email, and live chat support.

The support team is knowledgeable and responsive. They are available to help you with any questions or issues. FreshBooks also offers a comprehensive help center. This resource is full of articles and tutorials to guide you.

Having reliable customer support is crucial. It ensures you can use FreshBooks effectively for your tax needs.

Integration With Other Tools

FreshBooks is known for its user-friendly interface and robust features. One key feature is its seamless integration with other tools. This makes managing your finances much easier. Let’s explore how FreshBooks integrates with other tools to streamline your tax processes.

Accounting Software Integration

FreshBooks integrates effortlessly with various accounting software. This ensures your financial data is consistent and accurate. Popular software like QuickBooks and Xero sync with FreshBooks. This helps in maintaining a unified financial system.

Here’s a table outlining some key integrations:

| Software | Functionality |

|---|---|

| QuickBooks | Syncs invoices and expenses |

| Xero | Imports and exports financial data |

| Sage | Handles payroll and accounting |

These integrations ensure that your financial data is always up-to-date. This is crucial for accurate tax calculations. You can avoid manual data entry and reduce errors.

Bank Account Sync

Another powerful feature of FreshBooks is its ability to sync with bank accounts. This means you can automatically import transactions directly from your bank.

Here are the steps to sync your bank account with FreshBooks:

- Log in to your FreshBooks account.

- Navigate to the ‘Bank Accounts’ section.

- Select ‘Add Bank Account’ and follow the prompts.

- Enter your bank details securely.

- Confirm the connection and start importing transactions.

This automatic sync saves time and improves accuracy. You can easily categorize expenses and track income. It also helps in generating detailed financial reports.

Syncing your bank account with FreshBooks ensures you have real-time financial data. This is essential for accurate tax reporting and compliance.

With these integrations, FreshBooks simplifies your tax processes. This allows you to focus on growing your business.

Cost And Pricing

Understanding the cost and pricing of FreshBooks is crucial for small business owners. FreshBooks offers a range of subscription plans. Each plan is designed to meet different needs and budgets. Let’s dive into the details.

Subscription Plans

FreshBooks provides multiple subscription plans. These plans cater to various business sizes and requirements. Here’s a breakdown of the available plans:

| Plan | Monthly Cost | Features |

|---|---|---|

| Lite | $15 |

|

| Plus | $25 |

|

| Premium | $50 |

|

Value For Money

FreshBooks offers great value for money. Each plan includes essential features. These features help manage finances efficiently.

The Lite plan is perfect for freelancers. It allows for basic invoicing and expense tracking. The Plus plan is ideal for small businesses. It offers additional features like recurring billing.

For larger businesses, the Premium plan is the best choice. It supports unlimited billable clients and advanced payments. These features justify the higher cost.

Overall, FreshBooks provides a range of affordable options. Each plan is tailored to meet specific business needs. This ensures that FreshBooks can grow with your business.

Pros And Cons

Every accounting software has its strengths and weaknesses. FreshBooks is no different. If you wonder if FreshBooks can handle your taxes, this section will help. Let’s explore the pros and cons of using FreshBooks for taxes.

Advantages

- Ease of Use: FreshBooks is user-friendly. Even beginners can navigate it easily.

- Automated Invoicing: It automates invoicing. This saves time and reduces errors.

- Expense Tracking: FreshBooks tracks expenses efficiently. You can categorize and manage them with ease.

- Time Tracking: It helps track time spent on projects. This is useful for billing clients accurately.

- Tax Reports: FreshBooks provides detailed tax reports. These are helpful during tax season.

- Integration: It integrates with various tax software. This makes tax filing more seamless.

Limitations

- Limited Tax Features: FreshBooks has limited tax-specific features. It may not handle complex tax scenarios.

- Higher Cost: FreshBooks can be costly for small businesses. There are cheaper alternatives available.

- Learning Curve: Some features have a learning curve. It may take time to master them.

- No Payroll: FreshBooks lacks payroll features. You need separate software for payroll management.

- Support Limitations: Customer support is not 24/7. This may be inconvenient for some users.

Case Studies

Discover how FreshBooks has made tax season easier for small businesses. Read through these case studies to see real-world success stories and examples of FreshBooks in action.

Small Business Success Stories

Small businesses across various industries have benefited from using FreshBooks for taxes. Here are a few stories:

- John’s Cafe: John used to spend hours on tax calculations. With FreshBooks, his tax preparation time reduced by 50%. He could focus more on his cafe and less on paperwork.

- Susan’s Marketing Agency: Susan struggled with tracking expenses and invoices. FreshBooks helped her organize everything in one place. During tax season, her stress levels decreased significantly.

- Mike’s Landscaping Services: Mike had trouble tracking different clients and projects. FreshBooks made it easy to categorize expenses and revenue. Filing taxes became a breeze.

Real-world Examples

Let’s look at some real-world examples where FreshBooks proved to be an asset during tax season:

| Business | Problem | Solution | Outcome |

|---|---|---|---|

| Anna’s Boutique | Disorganized receipts | FreshBooks expense tracking | Organized finances, easy tax filing |

| Paul’s IT Services | Manual invoicing | Automated invoicing with FreshBooks | Faster payments, simplified tax reporting |

| Rachel’s Photography | Complex client management | Client management tools in FreshBooks | Streamlined operations, easier tax prep |

These examples show how FreshBooks can simplify tax season for small businesses. It helps save time, reduce stress, and improve accuracy. Businesses can then focus on growth and service quality.

Credit: support.freshbooks.com

Credit: www.freshbooks.com

Frequently Asked Questions

Can Freshbooks Handle Tax Calculations?

Yes, FreshBooks can handle tax calculations. It automatically applies tax rates to invoices and expenses. This makes tax management easier.

Does Freshbooks Generate Tax Reports?

Yes, FreshBooks generates tax reports. These reports help you keep track of tax obligations. They simplify tax filing.

Can Freshbooks Integrate With Tax Software?

Yes, FreshBooks integrates with many tax software. This ensures seamless data transfer for tax preparation. It saves you time.

Is Freshbooks Suitable For Freelancers During Tax Season?

Yes, FreshBooks is ideal for freelancers. It tracks expenses and income, simplifying tax season. It ensures accurate tax information.

Conclusion

FreshBooks can help streamline your tax process. Its features simplify financial tracking. You can generate reports, track expenses, and organize receipts easily. This can make tax time less stressful. FreshBooks is a valuable tool for small business owners. It supports efficient tax management.

Try it to see how it fits your needs. Remember, using the right tools can save you time. FreshBooks offers a helpful solution. Always consult a tax professional for specific advice.