Yes, FreshBooks integrates with TurboTax. This integration simplifies tax filing for business owners.

Managing finances can be a hassle, especially during tax season. FreshBooks, a popular accounting software, offers a solution by integrating with TurboTax. This integration allows seamless data transfer, reducing errors and saving time. Business owners can effortlessly prepare their taxes using data from FreshBooks, ensuring accuracy and efficiency.

This blog post will explore how this integration works, its benefits, and steps to set it up. Stay tuned to learn how FreshBooks and TurboTax can streamline your tax process.

Introduction To Freshbooks And Turbotax

Managing finances is a crucial task for any business. Freshbooks and Turbotax are two popular tools that help with this. Both offer unique features that make them stand out. But do they work together? Let’s explore what Freshbooks and Turbotax are, and how they can benefit you.

What Is Freshbooks?

Freshbooks is an accounting software designed for small businesses. It simplifies invoicing, time tracking, and expense management. Freshbooks helps you save time on administrative tasks. It also provides insights into your business performance.

Key features of Freshbooks:

- Easy invoicing

- Expense tracking

- Time tracking

- Project management

- Reporting and analytics

Freshbooks is known for its user-friendly interface. It is suitable for freelancers and small business owners. With Freshbooks, you can focus on growing your business.

What Is Turbotax?

Turbotax is a tax preparation software. It helps individuals and businesses file their taxes. Turbotax guides you through the tax filing process. It ensures you maximize your tax refunds.

Key features of Turbotax:

- Step-by-step guidance

- Accurate calculations

- Maximized deductions

- E-file options

- Audit support

Turbotax makes tax filing simple and stress-free. It is suitable for both personal and business tax returns. With Turbotax, you can be confident your taxes are done right.

Importance Of Seamless Accounting

In today’s fast-paced business world, seamless accounting is crucial. Integrating accounting tools enhances accuracy and efficiency. This is particularly important for small businesses that need to manage their finances efficiently.

Benefits For Small Businesses

Small businesses often operate with limited resources. They need tools that streamline their processes. FreshBooks and TurboTax integration offers significant benefits:

- Reduces manual data entry

- Minimizes errors

- Saves time

- Improves financial accuracy

With integration, financial data syncs automatically. This ensures up-to-date information. Business owners can focus on growth rather than bookkeeping.

Streamlining Financial Processes

Seamless accounting integration simplifies financial processes. FreshBooks helps manage invoices, expenses, and payments. TurboTax handles tax preparation. Together, they create a smooth workflow.

Here’s a comparison of key features:

| Feature | FreshBooks | TurboTax |

|---|---|---|

| Invoicing | Yes | No |

| Expense Tracking | Yes | No |

| Tax Filing | No | Yes |

These tools complement each other. FreshBooks tracks daily transactions. TurboTax prepares and files taxes using this data. The integration ensures all financial information is accurate and ready for tax season.

Integration Capabilities

FreshBooks and TurboTax are powerful tools for managing finances and taxes. Integrating these platforms can streamline your accounting process. This section will explore the integration capabilities between FreshBooks and TurboTax.

How Freshbooks Integrates With Turbotax

FreshBooks offers seamless integration with TurboTax. This allows you to transfer financial data easily. The integration ensures accurate tax reporting. You can import invoices, expenses, and payments into TurboTax. This saves time and reduces errors.

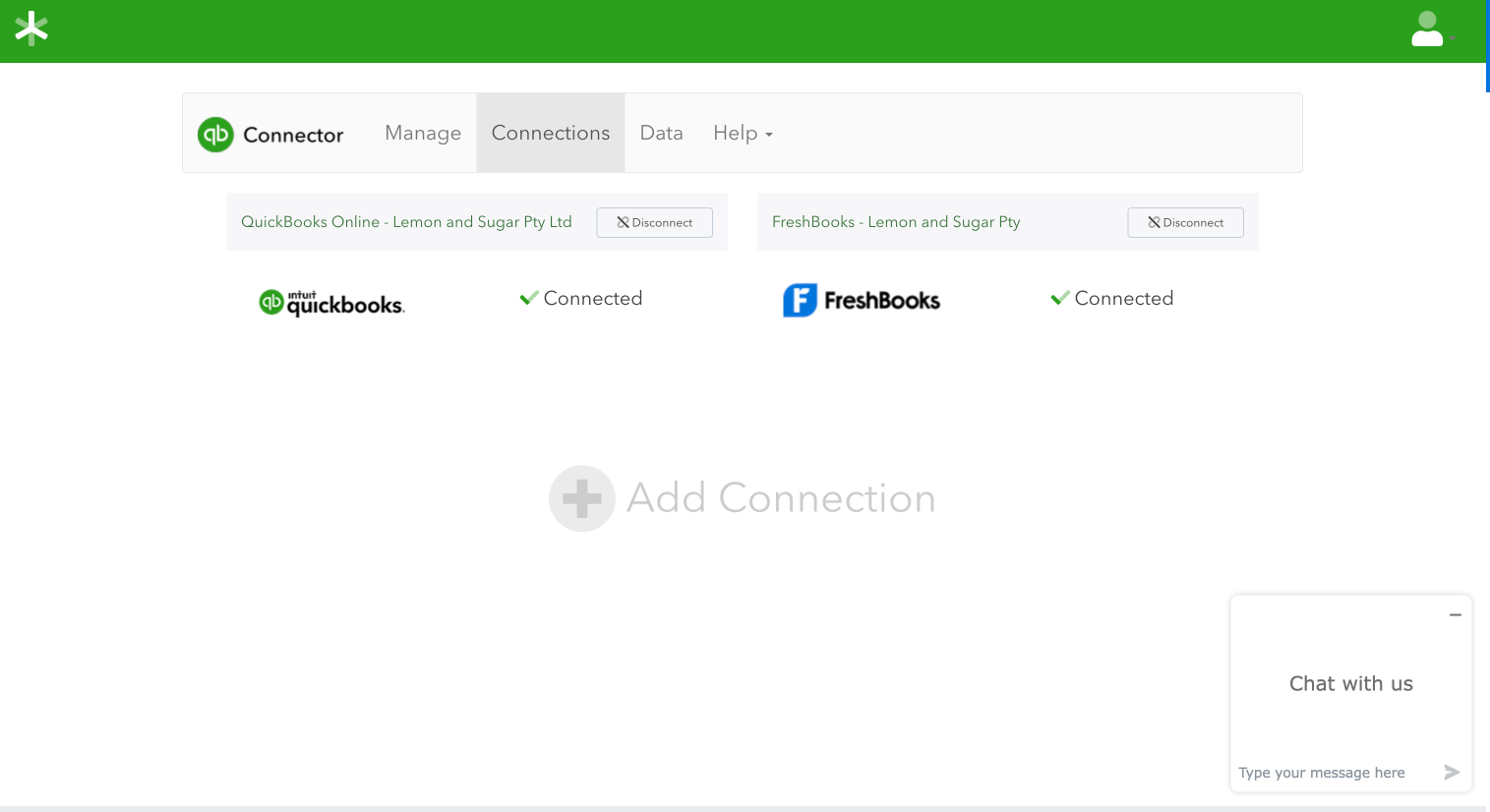

Steps To Connect Accounts

- Log in to your FreshBooks account.

- Navigate to the ‘Apps’ section.

- Search for ‘TurboTax’ and select it.

- Click ‘Connect’ to start the integration process.

- Log in to your TurboTax account.

- Authorize the connection between FreshBooks and TurboTax.

- Follow the prompts to complete the setup.

Once connected, FreshBooks will sync your financial data with TurboTax. This integration ensures your tax information is always up-to-date and accurate.

Credit: www.instagram.com

Features Of Freshbooks And Turbotax Integration

The integration between Freshbooks and Turbotax offers numerous features that enhance efficiency and accuracy for users. This collaboration simplifies the accounting process and ensures that your financial data remains up-to-date and error-free. Below, we delve into some of the key features of this integration.

Automatic Data Syncing

One of the most significant features of the Freshbooks and Turbotax integration is automatic data syncing. This feature ensures that your financial data is continuously updated between both platforms. You do not need to manually transfer data from one software to the other.

Automatic data syncing saves time and reduces the hassle of manually inputting data. Your invoices, expenses, and financial reports are always up-to-date. This provides peace of mind and allows you to focus on growing your business.

Error Minimization

Another essential feature of the Freshbooks and Turbotax integration is error minimization. Manual data entry often leads to mistakes. These errors can be costly and time-consuming to fix. By integrating Freshbooks with Turbotax, the system reduces human error.

The integration ensures that all financial data is accurate and consistent. This means you can trust your numbers when tax season arrives. Less time spent correcting errors means more time dedicated to business growth.

The integration between Freshbooks and Turbotax provides an efficient and reliable solution for managing your finances. With automatic data syncing and error minimization, your accounting process becomes seamless and stress-free.

User Experience

When considering software integrations, user experience is key. FreshBooks and TurboTax are two popular tools. Their integration aims to simplify accounting and tax filing. But how does this integration perform in practice?

Ease Of Use

The integration between FreshBooks and TurboTax is designed to be user-friendly. Both platforms focus on simplicity. Users often find the process seamless.

- Simple Setup: Connecting FreshBooks to TurboTax requires just a few steps.

- Intuitive Interface: Both platforms offer clean, easy-to-navigate interfaces.

- Automatic Data Sync: Information from FreshBooks syncs directly with TurboTax.

This means less manual entry and fewer errors. The integration saves time and reduces stress. Most users appreciate these benefits.

Customer Reviews

Customer feedback is crucial in assessing software performance. Reviews for the FreshBooks and TurboTax integration are generally positive.

| Feature | Rating | Comments |

|---|---|---|

| Ease of Use | 4.5/5 | Many users find it straightforward to connect. |

| Time-Saving | 4.7/5 | Automatic data sync is a favorite feature. |

| Accuracy | 4.6/5 | Less manual entry means fewer mistakes. |

Most reviews highlight the integration’s simplicity. Users enjoy the reduced workload during tax season. Some users mention minor glitches. But overall, satisfaction remains high.

Pricing And Plans

Understanding the pricing and plans of FreshBooks and TurboTax is crucial. It helps users decide if the integration suits their budget. This section will break down the subscription costs and assess the value for money.

Subscription Costs

FreshBooks offers several subscription plans. These are tailored to different business needs and sizes.

- Lite Plan: $15 per month. Best for freelancers.

- Plus Plan: $25 per month. Ideal for small businesses.

- Premium Plan: $50 per month. Suitable for growing businesses.

- Select Plan: Custom pricing. For large businesses with special needs.

TurboTax also offers various pricing tiers. Each caters to different tax filing requirements.

- Free Edition: $0. For simple tax returns.

- Deluxe: $60. Maximizes deductions and credits.

- Premier: $90. Best for investments and rental property.

- Self-Employed: $120. Ideal for freelancers and contractors.

Value For Money

FreshBooks and TurboTax integration offers significant value. Users can manage their finances and taxes efficiently. This integration saves time and reduces errors.

For small businesses, the Plus Plan at $25 per month is a good deal. It offers robust features and seamless integration with TurboTax.

Freelancers might find the Lite Plan paired with the Self-Employed TurboTax most cost-effective. This combination covers their accounting and tax needs at a reasonable price.

Large businesses benefit from the Select Plan. Though custom pricing, it provides specialized support and advanced features.

Overall, the integration of FreshBooks with TurboTax ensures users get value for their money. It simplifies both accounting and tax filing processes.

Common Issues And Solutions

FreshBooks and TurboTax integration offers many benefits. But, some users face challenges. Here are common issues and solutions for a smoother experience.

Troubleshooting Tips

Experiencing syncing issues? Ensure both FreshBooks and TurboTax are updated. Check your internet connection. Sometimes, a simple restart solves the problem. If the issue persists, reauthorize the connection between FreshBooks and TurboTax.

- Update both applications.

- Check your internet connection.

- Restart both applications.

- Reauthorize the integration.

Another common issue is missing data. Ensure you have selected the correct time frame. Check if the data is correctly categorized in FreshBooks. Incorrect categories can lead to missing entries in TurboTax.

- Check selected time frame.

- Verify data categorization in FreshBooks.

Customer Support

If troubleshooting does not solve your problem, contact customer support. Both FreshBooks and TurboTax offer excellent support. FreshBooks support can be reached via email or phone. TurboTax has a comprehensive help center and community forums.

| Service | Contact Method |

|---|---|

| FreshBooks | Email, Phone |

| TurboTax | Help Center, Forums |

Do not hesitate to seek help. The support teams are there to assist you. Always provide detailed information about your issue. This helps in quicker resolution.

Credit: www.billdu.com

Credit: quickbooks.intuit.com

Frequently Asked Questions

Does Freshbooks Integrate With Turbotax?

Yes, Freshbooks integrates with TurboTax. This integration helps streamline your tax filing process by importing your financial data directly into TurboTax.

How To Connect Freshbooks To Turbotax?

To connect Freshbooks to TurboTax, log into both accounts. Follow the integration prompts to link and import your data.

Is Freshbooks-turbotax Integration Free?

Yes, the integration between Freshbooks and TurboTax is free. However, you may need a subscription for both services.

Can I Import Expenses From Freshbooks To Turbotax?

Yes, you can import expenses from Freshbooks to TurboTax. This makes tax preparation easier and more accurate.

Conclusion

Freshbooks and Turbotax can work together for your accounting needs. This integration simplifies tax time. Easy to set up, it saves time and reduces errors. Small businesses benefit greatly from this. Streamline your accounting tasks with this handy feature. Stay on top of your finances easily.

Try integrating Freshbooks with Turbotax today for smoother operations.