Want to streamline payroll in FreshBooks? You’re in the right place.

FreshBooks makes managing payroll simple and efficient. Handling payroll can be stressful for small business owners. But with FreshBooks, the process becomes much easier. This guide will walk you through the steps to do payroll in FreshBooks, from setting up employee profiles to processing payments.

By the end, you’ll feel confident managing payroll on your own. Let’s dive into the details and simplify your payroll tasks today!

Introduction To Freshbooks Payroll

Freshbooks is a popular accounting software. It helps small businesses manage their finances. One of its key features is payroll management. Freshbooks Payroll simplifies the process of paying employees. It ensures accuracy and saves time. Let’s explore how Freshbooks can help with payroll.

What Is Freshbooks?

Freshbooks is cloud-based accounting software. It is designed for small businesses. The software offers various financial tools. It helps with invoicing, expense tracking, and financial reporting.

Freshbooks is user-friendly. It has a simple interface. This makes it easy for non-accountants to use. The software also integrates with other apps. This allows for seamless financial management.

Benefits Of Using Freshbooks For Payroll

Using Freshbooks for payroll offers many benefits. Here are some of the key advantages:

- Accuracy: Freshbooks ensures accurate payroll calculations.

- Time-saving: Automates many payroll tasks, saving time.

- Compliance: Keeps you compliant with tax regulations.

- Integration: Integrates with other financial tools and apps.

- User-friendly: Easy to use, even for non-accountants.

Freshbooks Payroll helps small businesses. It simplifies complex payroll tasks. This allows business owners to focus on growth.

Setting Up Your Freshbooks Account

Freshbooks is an excellent tool for managing payroll. To get started, setting up your account correctly is essential. This guide will walk you through the initial steps of creating an account and configuring your settings to ensure a smooth payroll process.

Creating An Account

To create an account in Freshbooks, follow these simple steps:

- Visit the Freshbooks website.

- Click on the “Get Started Free” button.

- Enter your email address and create a password.

- Fill in your business information such as name and address.

- Select the plan that fits your needs.

- Complete the registration by clicking on the “Sign Up” button.

Once your account is created, you will receive a confirmation email. Verify your email to activate your account fully.

Configuring Account Settings

Proper configuration of your account settings is crucial. Here’s how you can configure your settings:

- Log in to your Freshbooks account.

- Go to the “Settings” tab located on the left sidebar.

- Update your business profile with accurate information.

- Set your currency and time zone.

- Configure your invoice settings such as payment terms and late fees.

- Enable notifications to stay updated with important activities.

Make sure to save your settings after making changes.

To further customize your account, you can set up payment gateways. This allows clients to pay you online. Go to the “Payments” section and follow the instructions to add your preferred payment methods.

With your Freshbooks account set up, you’re ready to manage payroll efficiently. Keep your information updated to ensure smooth transactions and accurate records.

Adding Employees

Adding employees to your FreshBooks payroll is a crucial step. This ensures each team member gets paid accurately. Let’s dive into the steps you need to follow.

Employee Information Required

Before you add employees, gather their essential details. This information is vital for accurate payroll processing.

- Full Name: Ensure the name matches official documents.

- Address: This includes street, city, state, and ZIP code.

- Social Security Number (SSN): Needed for tax purposes.

- Bank Details: For direct deposit of salaries.

- Job Title: Specify their role in your company.

- Hire Date: The date they started working for you.

- Salary Information: Their pay rate and pay frequency.

Steps To Add Employees

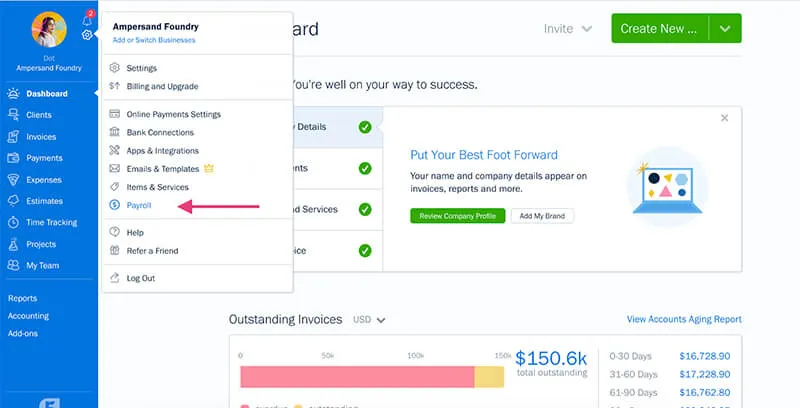

Follow these simple steps to add employees in FreshBooks:

- Log In: Access your FreshBooks account.

- Navigate to Payroll: Go to the “Payroll” section from the main menu.

- Add Employee: Click on “Add Employee” button.

- Enter Information: Fill in the employee’s details. Use the information you gathered earlier.

- Save: Click “Save” to add the employee to your payroll system.

That’s it! You’ve successfully added an employee to FreshBooks payroll. Repeat these steps for each new hire.

Entering Payroll Information

Managing payroll can be challenging, but FreshBooks simplifies the process. Entering payroll information is a crucial step in ensuring accurate employee payments. This guide will help you navigate through the process efficiently.

Salary And Wages

To begin, you need to input each employee’s salary and wages. Follow these steps:

- Navigate to the Payroll section in your FreshBooks dashboard.

- Select the employee whose salary you want to enter.

- Enter the hourly rate or annual salary in the designated field.

- Ensure all information is accurate and click Save.

It’s essential to verify each detail to avoid errors. This includes checking the employee’s name, position, and salary type.

Deductions And Taxes

Next, input the necessary deductions and taxes. This ensures compliance with legal requirements. Here’s how:

- Go to the Deductions tab within the employee’s payroll profile.

- Enter mandatory deductions such as federal taxes, state taxes, and social security.

- Add any additional deductions like health insurance or retirement contributions.

- Double-check the amounts and click Save.

These steps ensure each employee’s paycheck is accurate and compliant. Keep all tax documents handy for reference.

FreshBooks makes managing payroll straightforward. By carefully entering payroll information, you ensure timely and accurate payments.

Running Payroll

Running payroll in FreshBooks is essential for managing your team’s earnings. It ensures that employees get paid accurately and on time. Let’s delve into the process of running payroll in FreshBooks.

Scheduling Payroll

Scheduling payroll in FreshBooks is straightforward and helps in avoiding delays. Follow these steps:

- Log in to your FreshBooks account.

- Navigate to the Payroll section.

- Select the Schedule option.

- Choose the desired payroll frequency (weekly, bi-weekly, monthly).

- Set the payday for your employees.

Proper scheduling ensures timely payments and satisfied employees.

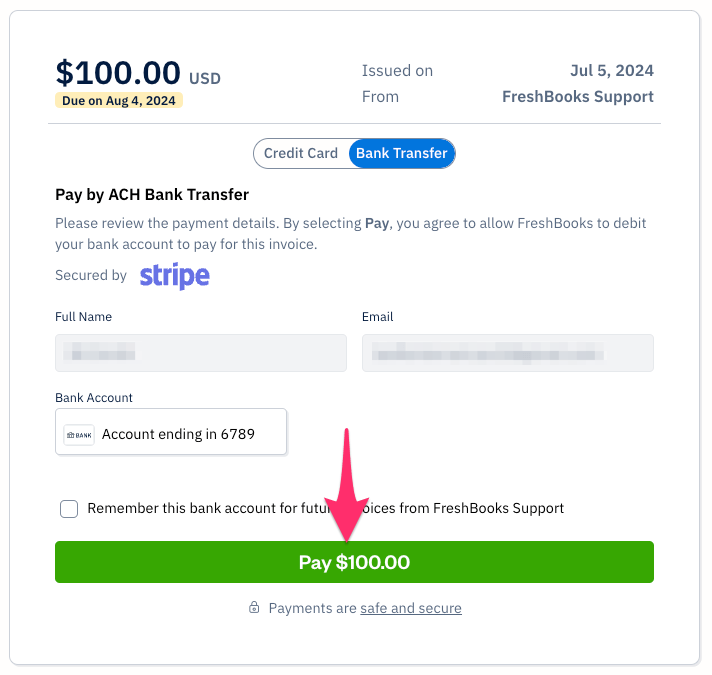

Processing Payments

After scheduling, you need to process the payments. This involves calculating wages, taxes, and deductions. Follow these steps:

- Go to the Payroll section in FreshBooks.

- Select the Process Payroll option.

- Enter the work hours for each employee.

- FreshBooks will automatically calculate the wages, taxes, and deductions.

- Review the calculations to ensure accuracy.

- Click on Submit to finalize the payroll.

Make sure to double-check the entered data to avoid errors.

Credit: www.freshbooks.com

Reviewing Payroll Reports

Reviewing payroll reports in FreshBooks is essential for maintaining accurate financial records. It helps ensure compliance with tax regulations and provides insights into employee compensation. By examining these reports, you can identify trends and make informed decisions about your business finances.

Types Of Reports

FreshBooks offers various payroll reports to help you track and manage employee payments. These reports provide detailed information that is easy to understand.

- Payroll Summary Report: This report gives an overview of total wages, taxes, and deductions for a specific period.

- Employee Earnings Report: This report shows individual employee earnings, including gross pay, taxes, and net pay.

- Payroll Tax Liability Report: This report details the taxes you owe to federal, state, and local authorities.

- Payroll Journal Report: This report provides a comprehensive record of all payroll transactions.

Analyzing Payroll Data

Analyzing payroll data helps you understand your payroll expenses and identify areas for improvement. Here are some key aspects to consider:

- Compare Periods: Look at payroll data across different periods to identify trends. Are your payroll costs increasing or decreasing?

- Check for Errors: Ensure there are no discrepancies in employee earnings, taxes, or deductions.

- Monitor Tax Liabilities: Keep track of your tax liabilities to avoid penalties and ensure compliance with regulations.

- Evaluate Overtime Costs: Analyze overtime expenses to manage labor costs effectively.

Using FreshBooks payroll reports helps you stay on top of your payroll process. It ensures your business runs smoothly and complies with all financial regulations.

Compliance And Tax Filing

Managing payroll involves more than just paying employees. Compliance and tax filing are critical parts of the process. Freshbooks helps you handle these tasks smoothly. This guide will help you understand compliance and how to file taxes using Freshbooks.

Understanding Compliance

Compliance means following all legal rules and regulations. This includes labor laws, tax laws, and employment standards. Freshbooks helps you stay compliant by providing tools to track and report necessary details.

Here are some key points to keep in mind:

- Ensure employee classification (full-time, part-time, contractor).

- Track employee hours accurately.

- Stay updated with changing tax laws.

- Maintain proper records of all payments and deductions.

Filing Taxes With Freshbooks

Filing taxes can be complex, but Freshbooks simplifies it. The platform helps you manage payroll taxes efficiently. Follow these steps to file taxes with Freshbooks:

- Log in to your Freshbooks account.

- Navigate to the Payroll section.

- Review and approve employee payroll details.

- Generate payroll reports.

- Use the reports to fill out tax forms.

- Submit the forms to the relevant tax authorities.

Here’s a quick look at the types of reports you might need:

| Report Type | Description |

|---|---|

| W-2 | For employees, showing total earnings and taxes withheld. |

| 1099 | For contractors, showing total payments made during the year. |

| Quarterly Tax Reports | Summarizes payroll taxes due every quarter. |

Freshbooks makes it easier to stay compliant and file taxes correctly. Follow these steps and use the tools provided. This ensures smooth payroll management and peace of mind.

Troubleshooting Common Issues

Handling payroll in FreshBooks can be smooth. But sometimes, issues arise. Knowing how to troubleshoot common problems can save time and stress.

Error Messages

Encountering error messages? It’s common while processing payroll. First, read the message carefully. It often tells you what went wrong.

Check your internet connection. A stable connection is crucial. Also, ensure your FreshBooks account is active and in good standing.

Here are some typical error messages and solutions:

| Error Message | Solution |

|---|---|

| Invalid Employee Information | Review and update employee details |

| Payment Processing Error | Verify payment methods and bank details |

| Insufficient Funds | Ensure your account has enough funds |

Contacting Support

Still facing issues? FreshBooks support is there to help.

- Log in to your FreshBooks account.

- Click on the Help icon at the top right.

- Select the Contact Us option.

You can reach out via email or phone. Provide detailed information about your issue. Include screenshots if possible. This helps support resolve your problem faster.

Remember, FreshBooks also has a comprehensive Help Center. It contains articles and guides. These can assist in solving many common issues.

Tips For Efficient Payroll Management

Managing payroll can be challenging. Yet, with the right tips, you can make it efficient. Here are some actionable tips to ensure your payroll process is smooth and effective.

Automation Tips

Automation can save you time and reduce errors. FreshBooks offers several automation features.

- Set up automatic payments: Schedule payments for recurring tasks.

- Use time tracking: Automatically track employee hours within FreshBooks.

- Generate payroll reports: Use automated reports to keep track of payroll data.

Best Practices

Following best practices ensures your payroll is accurate and compliant. Here are some essential steps to follow:

- Regularly update employee information: Keep records current to avoid mistakes.

- Classify employees correctly: Ensure employees are categorized appropriately.

- Review payroll laws: Stay updated on local and federal payroll regulations.

- Conduct audits: Regular payroll audits help identify and fix issues.

| Task | Frequency |

|---|---|

| Update employee information | Monthly |

| Classify employees | Quarterly |

| Review payroll laws | Annually |

| Conduct audits | Bi-Annually |

Credit: support.freshbooks.com

Credit: globalfintechseries.com

Frequently Asked Questions

How Do I Set Up Payroll In Freshbooks?

To set up payroll in FreshBooks, navigate to the payroll section. Follow the step-by-step instructions provided. Ensure you have all employee information ready.

Can Freshbooks Handle Payroll Taxes?

Yes, FreshBooks can handle payroll taxes. It automatically calculates, files, and pays your payroll taxes. This ensures compliance and saves time.

Is Freshbooks Payroll Suitable For Small Businesses?

Yes, FreshBooks payroll is ideal for small businesses. It’s user-friendly, efficient, and integrates seamlessly with other accounting features.

How Often Does Freshbooks Process Payroll?

FreshBooks processes payroll on a schedule you set. You can choose weekly, bi-weekly, semi-monthly, or monthly payroll cycles.

Conclusion

Managing payroll in FreshBooks can be simple and efficient. Follow the steps we discussed. Your business will benefit from the streamlined process. Accurate records mean fewer headaches at tax time. FreshBooks offers tools to keep payroll stress-free. Start today and see the difference.

Your employees will appreciate timely payments. Make payroll a breeze with FreshBooks.