Yes, FreshBooks can handle payroll. But it’s not as straightforward as you might think.

FreshBooks is known for its accounting features, but payroll isn’t its primary function. FreshBooks focuses on invoicing and expense tracking. It excels in helping small businesses manage their finances. But when it comes to payroll, things get a bit tricky.

FreshBooks offers payroll services through integrations with third-party providers. This means you need to connect FreshBooks to a payroll service to handle employee payments. While this may seem cumbersome, it allows businesses to keep all financial data in one place. In this blog post, we’ll explore how FreshBooks handles payroll, the integration process, and whether it’s the right choice for your business needs. Stay tuned to learn more!

Introduction To Freshbooks

FreshBooks is a popular accounting software designed for small businesses. It helps manage invoices, expenses, and time tracking. Many users wonder if it also handles payroll. Let’s explore its features to understand its capabilities.

What Is Freshbooks?

FreshBooks is a cloud-based accounting solution. It simplifies bookkeeping tasks. Small businesses and freelancers use it worldwide. The software is user-friendly and intuitive.

Key Features

FreshBooks offers a range of features to streamline financial tasks.

- Invoicing: Create and send professional invoices.

- Expense Tracking: Easily track business expenses.

- Time Tracking: Log billable hours effortlessly.

- Reports: Generate financial reports for insights.

- Payments: Accept online payments quickly.

- Project Management: Manage projects and collaborate with clients.

While FreshBooks excels in these areas, it does not include payroll services directly. Users often integrate with third-party payroll providers.

| Feature | Description |

|---|---|

| Invoicing | Create and send professional invoices. |

| Expense Tracking | Track business expenses easily. |

| Time Tracking | Log billable hours effortlessly. |

| Reports | Generate financial reports for insights. |

| Payments | Accept online payments quickly. |

| Project Management | Manage projects and collaborate with clients. |

Credit: www.freshbooks.com

Freshbooks And Payroll

FreshBooks is known for its easy-to-use accounting software. But can it handle payroll? The answer is both yes and no. FreshBooks itself does not have built-in payroll services. But it offers integration options to manage payroll efficiently.

Payroll Capabilities

FreshBooks does not directly offer payroll services. It focuses on invoicing, expense tracking, and time tracking. But it allows seamless integration with popular payroll services. This ensures you can manage payroll without leaving FreshBooks.

| Feature | Available in FreshBooks |

|---|---|

| Invoicing | Yes |

| Expense Tracking | Yes |

| Time Tracking | Yes |

| Payroll | No (Integration Required) |

Integration Options

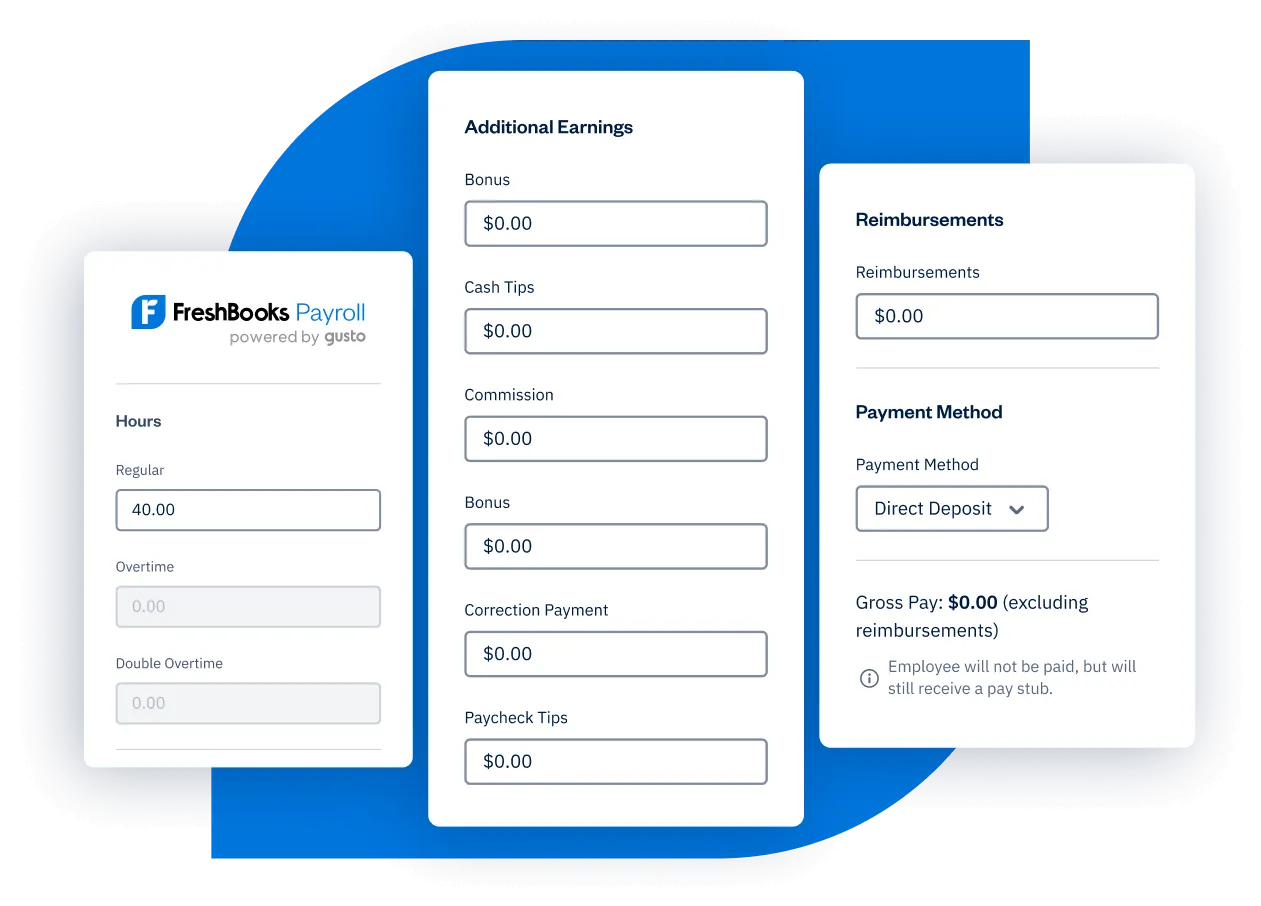

FreshBooks integrates with various payroll services. This makes it easier to manage your payroll tasks. Some popular integrations include:

- Gusto: Gusto offers complete payroll solutions. It handles taxes, benefits, and compliance.

- QuickBooks Payroll: QuickBooks Payroll is known for its user-friendly interface. It offers comprehensive payroll features.

- Wagepoint: Wagepoint is great for small businesses. It simplifies payroll management.

These integrations allow you to sync payroll data with FreshBooks. This ensures your accounting and payroll data are always up-to-date.

Benefits Of Using Freshbooks For Payroll

Managing payroll can be a challenging task for small businesses. FreshBooks, a popular accounting software, offers a comprehensive payroll solution. This can save time and reduce errors. Let’s explore the benefits of using FreshBooks for payroll.

Efficiency

FreshBooks streamlines the payroll process. It automates many tasks, which saves time. This allows you to focus on other important business matters. Using FreshBooks, you can:

- Automate payroll calculations: No more manual calculations.

- Generate payslips: Quickly create and distribute payslips to employees.

- File taxes: Simplify tax filing with built-in features.

Efficiency in payroll management can reduce operational costs. This is especially beneficial for small businesses with limited resources.

Accuracy

Ensuring accuracy in payroll is crucial. FreshBooks helps minimize errors. This protects your business from costly mistakes. Key features include:

- Automatic calculations: FreshBooks calculates payroll taxes accurately.

- Compliance checks: Stay compliant with local and federal regulations.

- Real-time updates: Get accurate data with real-time updates.

Accurate payroll processing ensures employees are paid correctly. It also helps maintain trust and satisfaction among your staff.

| Feature | Description |

|---|---|

| Automated Payroll | Automates payroll calculations to save time. |

| Compliance | Ensures compliance with regulations. |

| Real-Time Updates | Provides accurate and up-to-date payroll data. |

Setting Up Payroll In Freshbooks

Managing payroll can be a daunting task. But with FreshBooks, it becomes simple. FreshBooks offers tools to help you set up and manage payroll efficiently. This guide will walk you through the steps of setting up payroll in FreshBooks.

Initial Setup

To start, log in to your FreshBooks account. Navigate to the payroll section. Here, you will find options to configure your payroll settings.

Steps to follow:

- Go to the Payroll tab.

- Click on Get Started.

- Enter your company details and tax information.

- Specify your pay schedule and employee details.

Once you have entered all the required information, click Save. Your initial setup is now complete.

Connecting Bank Accounts

Connecting your bank account is crucial for seamless payroll processing. FreshBooks allows you to link your bank account easily.

Steps to connect your bank account:

- Go to Settings.

- Click on Bank Accounts.

- Select Add Bank Account.

- Follow the prompts to securely link your bank account.

Once your bank account is connected, FreshBooks will handle payroll transactions automatically. This ensures timely payments to your employees.

By following these simple steps, you can set up payroll in FreshBooks with ease. This will help you manage your payroll efficiently and accurately.

Managing Employee Information

Managing employee information can be a daunting task. FreshBooks offers features to streamline this process. This section will explore how to manage employee information using FreshBooks. We will cover adding employees and updating records.

Adding Employees

Adding employees to FreshBooks is straightforward. Follow these steps:

- Navigate to the ‘Employees’ section.

- Click on the ‘Add Employee’ button.

- Fill in the required fields:

- First Name

- Last Name

- Email Address

- Job Title

- Click ‘Save’ to add the employee.

These simple steps ensure your team is added quickly and accurately.

Updating Records

Keeping employee records up to date is crucial. FreshBooks makes this easy:

- Go to the ‘Employees’ section.

- Select the employee you wish to update.

- Click ‘Edit’ next to their name.

- Update the necessary fields, such as:

- Contact Information

- Address

- Job Title

- Department

- Click ‘Save’ to keep the changes.

Regularly updating records ensures your data remains accurate.

| Field | Description |

|---|---|

| First Name | Employee’s given name. |

| Last Name | Employee’s family name. |

| Email Address | Employee’s work email. |

| Job Title | Employee’s role in the company. |

Using FreshBooks to manage employee information simplifies your workflow. It ensures data accuracy. It also helps in maintaining an organized system.

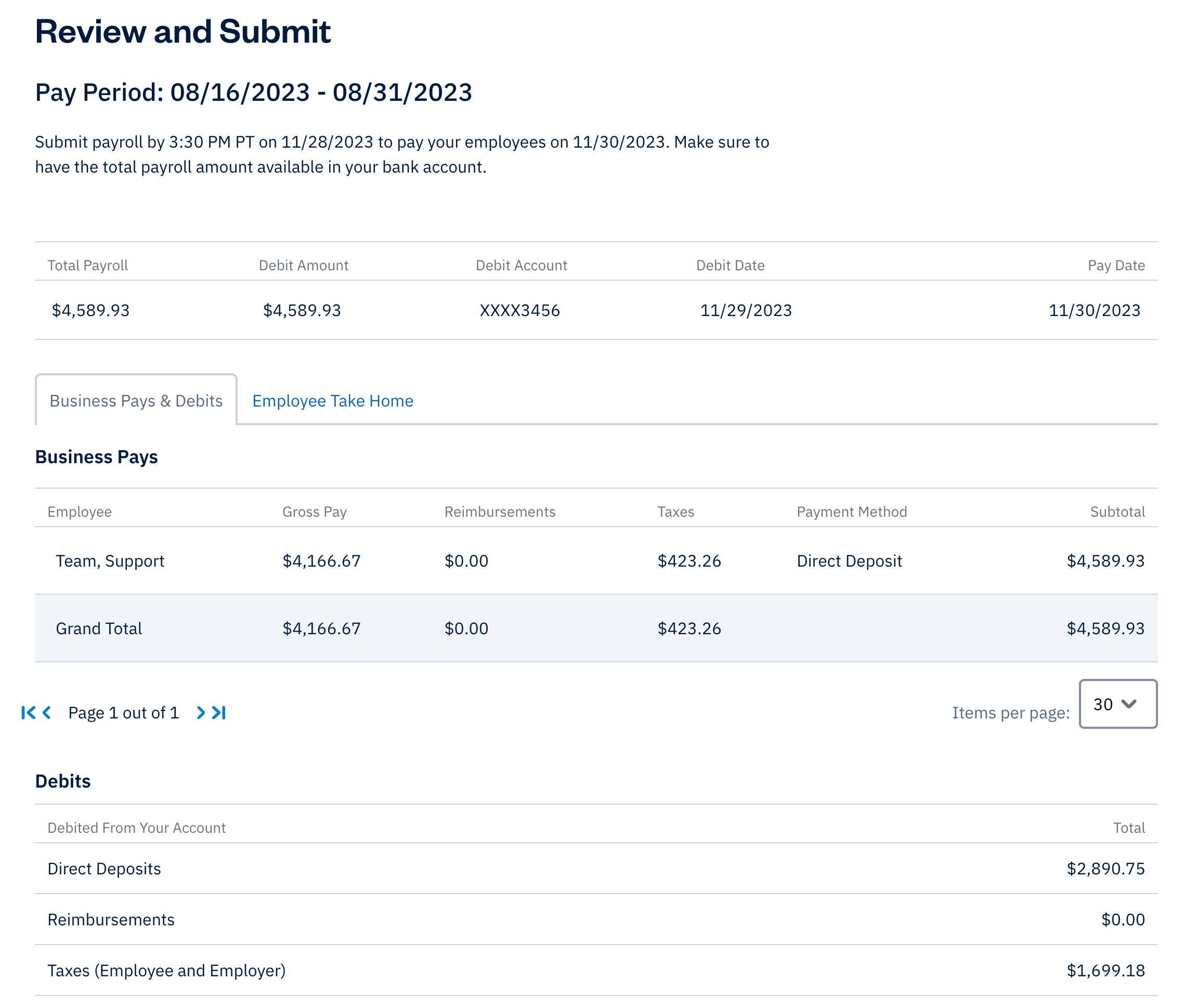

Credit: support.freshbooks.com

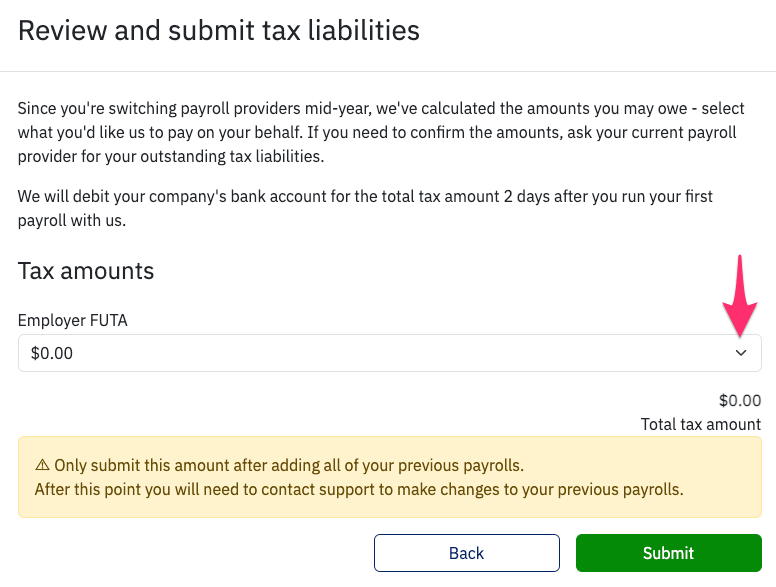

Handling Payroll Taxes

Handling payroll taxes can be a complex and time-consuming task. Business owners must ensure accurate calculations and timely filings. FreshBooks offers features to manage payroll taxes efficiently. Let’s dive into the details of how FreshBooks handles these critical aspects.

Tax Calculations

FreshBooks simplifies tax calculations for payroll. The software automatically calculates federal, state, and local taxes. This ensures accuracy and reduces the risk of errors. Here’s a quick overview:

- Federal Taxes: FreshBooks computes federal income tax, Social Security, and Medicare.

- State Taxes: It handles state income tax and unemployment insurance.

- Local Taxes: FreshBooks accounts for local taxes specific to your area.

Using FreshBooks, you can be confident that your tax calculations are precise. This saves time and minimizes mistakes.

Filing Requirements

Meeting filing requirements is crucial for any business. FreshBooks assists in preparing and filing necessary documents. The software generates reports needed for tax filings. These reports include:

- W-2 Forms: For employee wage and tax statements.

- 1099 Forms: For reporting payments to contractors.

- Quarterly Tax Reports: For federal and state tax agencies.

FreshBooks also sends reminders for upcoming filing deadlines. This helps you stay on top of your tax obligations. With FreshBooks, compliance with filing requirements becomes easier and more manageable.

Automating Payroll Processes

Managing payroll manually can be time-consuming and prone to errors. Automating payroll processes helps to streamline these tasks, ensuring accuracy and efficiency. FreshBooks offers features that make payroll automation seamless and straightforward.

Scheduled Payments

With FreshBooks, you can set up scheduled payments for your employees. This ensures that everyone gets paid on time, every time. You simply input the payment dates, and FreshBooks takes care of the rest.

- No more missed paydays.

- Reduced administrative workload.

- Consistent payment schedules.

Setting up scheduled payments can also help in managing cash flow better. You can plan your expenses in advance without any surprises.

Notifications

FreshBooks also provides notifications to keep you updated on your payroll status. You get alerts for upcoming payments, payroll submissions, and more.

- Never miss a payroll deadline.

- Stay informed about payroll processes.

- Quick resolution of payroll issues.

These notifications help you stay on top of your payroll tasks, ensuring that everything runs smoothly.

By automating payroll processes with FreshBooks, you save time and reduce stress. You can focus on growing your business while FreshBooks handles the payroll.

Credit: support.freshbooks.com

Common Challenges And Solutions

Managing payroll can be challenging for many small businesses. FreshBooks offers some solutions, but there are still some common challenges. Let’s explore these challenges and the solutions FreshBooks provides.

Troubleshooting Errors

Errors can occur during payroll processing. These can include incorrect employee details or miscalculated taxes. FreshBooks provides tools to help identify and fix these errors. Here are some common errors and their solutions:

| Error Type | Solution |

|---|---|

| Incorrect Employee Details | Update the employee information in the system. |

| Miscalculated Taxes | Review tax settings and ensure they are up-to-date. |

FreshBooks also offers automated checks to catch errors before they affect payroll. This helps reduce mistakes and save time.

Customer Support

Good customer support is crucial for resolving issues quickly. FreshBooks provides several customer support options:

- Email Support: Send an email to get help with any issues.

- Phone Support: Call their support team for immediate assistance.

- Knowledge Base: Access articles and guides for self-help.

FreshBooks’ customer support team is well-trained and can help resolve most issues. This ensures smooth payroll operations for your business.

Comparing Freshbooks With Other Payroll Solutions

FreshBooks is a popular accounting software known for its user-friendly interface. But can it handle payroll? To understand this, let’s compare FreshBooks with other payroll solutions like QuickBooks Payroll and Gusto.

Quickbooks Payroll

QuickBooks Payroll is a comprehensive tool that integrates well with QuickBooks accounting software. It offers various features:

- Automated payroll: Reduces manual tasks.

- Tax filing: Handles federal and state tax filings.

- Employee benefits: Provides health insurance and retirement plans.

QuickBooks Payroll is ideal for businesses already using QuickBooks. It ensures a seamless experience with integrated data and reports.

Gusto

Gusto is another strong competitor in the payroll software market. It offers a range of features:

- Full-service payroll: Manages payroll taxes and filings.

- Employee benefits: Offers health insurance, 401(k) plans, and more.

- HR tools: Provides tools for onboarding and compliance.

Gusto is known for its user-friendly interface and excellent customer support. It is suitable for small to medium-sized businesses looking for a comprehensive payroll solution.

Here is a simple comparison table:

| Feature | FreshBooks | QuickBooks Payroll | Gusto |

|---|---|---|---|

| Automated Payroll | No | Yes | Yes |

| Tax Filing | No | Yes | Yes |

| Employee Benefits | No | Yes | Yes |

| HR Tools | No | No | Yes |

From the table, it is clear that FreshBooks lacks payroll functionalities. For robust payroll features, QuickBooks Payroll or Gusto are better options.

Frequently Asked Questions

Can Freshbooks Handle Payroll Services?

No, FreshBooks does not have built-in payroll services. However, it integrates with third-party payroll providers like Gusto.

What Payroll Software Integrates With Freshbooks?

FreshBooks integrates with Gusto for payroll services. Gusto handles employee payroll, benefits, and tax filings.

How To Connect Freshbooks With Gusto Payroll?

To connect FreshBooks with Gusto, go to the integrations section in FreshBooks. Follow the prompts to link your Gusto account.

Does Freshbooks Offer Employee Time Tracking?

Yes, FreshBooks offers time tracking features. Employees can log their hours directly within the FreshBooks platform.

Conclusion

FreshBooks offers many features for small businesses. Their payroll integration is a standout. With the Gusto partnership, managing payroll becomes simple. You can handle taxes, employee payments, and more. Everything syncs easily with your FreshBooks account. This saves time and reduces errors.

Small business owners can focus on growth. FreshBooks and Gusto together make payroll efficient and stress-free. So, consider using FreshBooks for your payroll needs. Your business operations will run smoother.