Tracking income in FreshBooks is straightforward. It helps manage finances efficiently.

Managing your business finances can be challenging. But with FreshBooks, tracking income becomes easier. FreshBooks offers an intuitive platform for small business owners and freelancers. It helps monitor earnings and expenses seamlessly. This guide will show you how to track income in FreshBooks.

You will learn step-by-step processes to ensure accurate financial records. By the end, you will understand how FreshBooks simplifies income tracking. This will lead to better financial management and decision-making. Ready to dive in? Let’s explore how you can track your income effectively with FreshBooks.

Introduction To Freshbooks

FreshBooks is a popular cloud-based accounting software. It’s designed for small business owners and freelancers. It helps with managing income, expenses, and invoicing. FreshBooks is known for its user-friendly interface. It makes accounting tasks simple and efficient.

Why Choose Freshbooks

FreshBooks offers many benefits for small business owners. Here are a few reasons to choose it:

- Easy to Use: FreshBooks has an intuitive design. Even beginners can use it with ease.

- Cloud-Based: Access your data from anywhere. All you need is an internet connection.

- Time-Saving: Automate tasks like invoicing and expense tracking. Spend less time on accounting.

- Support: FreshBooks offers excellent customer support. Get help when you need it.

Key Features

FreshBooks comes with a range of features. These features help you manage your finances efficiently.

| Feature | Description |

|---|---|

| Invoicing | Create professional invoices in minutes. Customize them to match your brand. |

| Expense Tracking | Track your expenses easily. Snap photos of receipts on the go. |

| Time Tracking | Track your time spent on projects. Bill clients accurately. |

| Reports | Generate detailed financial reports. Understand your business performance better. |

| Payments | Accept online payments. Get paid faster. |

FreshBooks simplifies accounting for small businesses. It offers essential tools to manage income, expenses, and more. Give it a try and see the difference.

Credit: www.freshbooks.com

Setting Up Freshbooks

Setting up FreshBooks is essential for accurate income tracking. FreshBooks offers an intuitive interface, making it easy for users to manage their finances efficiently. Let’s walk through the initial setup process.

Creating An Account

To start, you need to create an account on FreshBooks. Follow these simple steps:

- Visit the FreshBooks website.

- Click on the “Get Started” button.

- Enter your email address and create a password.

- Follow the on-screen instructions to complete the registration process.

Once your account is set up, you can begin customizing it to suit your needs.

Configuring Preferences

Configuring your preferences ensures that FreshBooks works best for you. Here are the key areas to focus on:

- Company Profile: Enter your business name, address, and contact details.

- Currency Settings: Choose the currency you will be using.

- Invoice Customization: Add your logo and choose a template for your invoices.

- Tax Information: Set up your tax rates to apply them to your invoices.

Ensure all information is accurate to prevent future discrepancies.

Setting up FreshBooks correctly from the start will save you time and ensure accurate income tracking. By following these steps, you can efficiently manage your finances and focus more on growing your business.

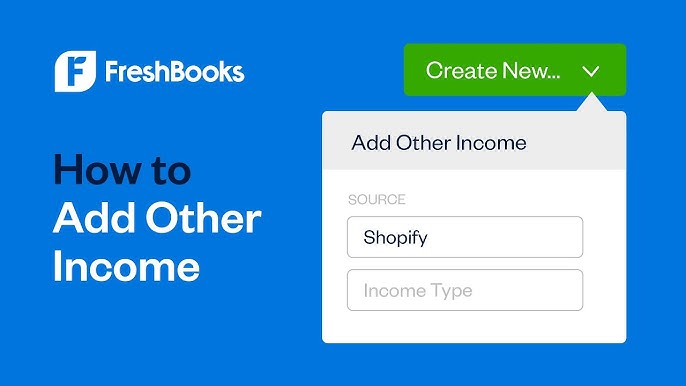

Adding Income Sources

Tracking income in FreshBooks is crucial for managing your finances effectively. Adding income sources helps you keep a clear record of your earnings. In this section, we will explore how to link bank accounts and manually enter income to ensure all your financial data is up-to-date.

Linking Bank Accounts

Linking your bank accounts in FreshBooks is a simple process. This ensures that all your transactions are automatically imported. Follow these steps:

- Log in to your FreshBooks account.

- Navigate to the Bank Accounts section.

- Click on Add Bank Account.

- Select your bank from the list.

- Enter your bank login credentials.

- Authorize FreshBooks to access your bank data.

Once linked, FreshBooks will import your transactions. This saves you time and reduces errors. You can categorize and match these transactions to your invoices.

Manual Income Entry

Sometimes, you need to enter income manually. This is essential for cash transactions or earnings not linked to your bank. Here’s how:

- Go to the Income tab in FreshBooks.

- Click on New Income.

- Fill in the details, including amount, date, and source.

- Select the client associated with the income.

- Save the entry.

Manual entries ensure all income is recorded. This keeps your financial records accurate. Regularly review and update these entries to maintain consistency.

By efficiently adding income sources, you maintain a clear financial picture. This helps in budgeting and forecasting. Ensure to regularly update both linked accounts and manual entries for accuracy.

Credit: www.voc.ai

Invoicing Clients

Tracking income in FreshBooks starts with invoicing your clients. Invoices help you request payments and keep your finances organized. FreshBooks makes this process easy and efficient.

Creating Invoices

Creating invoices in FreshBooks is simple. Follow these steps:

- Log into your FreshBooks account.

- Navigate to the Invoices section.

- Click on the Create New Invoice button.

Fill in the necessary details:

- Client’s Name: Enter the client’s name.

- Invoice Date: Choose the date of the invoice.

- Due Date: Set a due date for payment.

- Items or Services: List the items or services provided.

- Amount: Enter the amount for each item or service.

Click Save or Send to finalize the invoice.

Setting Up Recurring Invoices

Recurring invoices save time and ensure regular payments. To set up a recurring invoice:

- Go to the Invoices section.

- Click on the Create Recurring Profile button.

Fill in the details similar to a regular invoice:

- Client’s Name: Enter the client’s name.

- Frequency: Choose how often the invoice repeats (e.g., monthly).

- Start Date: Select the date to start invoicing.

- End Date: Set an end date or leave it open-ended.

- Items or Services: List the items or services provided.

- Amount: Enter the amount for each item or service.

Click Save to activate the recurring invoice profile.

FreshBooks will now automatically send these invoices based on your settings.

Tracking Payments

Tracking payments in FreshBooks is crucial for maintaining accurate records. Knowing how to record and manage payments ensures your business runs smoothly. FreshBooks offers several features to help you track payments effectively.

Recording Payments

To record payments in FreshBooks, follow these steps:

- Log in to your FreshBooks account.

- Navigate to the Invoices section.

- Select the invoice you wish to record a payment for.

- Click on the Record Payment button.

- Enter the payment details, such as the amount and date.

- Click Save to complete the process.

Recording payments helps you keep track of income and monitor cash flow. This practice ensures your financial records are up-to-date and accurate.

Automating Payment Reminders

FreshBooks also allows you to automate payment reminders. This feature helps you follow up with clients who have outstanding invoices.

Here’s how to set up automated payment reminders:

- Go to the Settings menu.

- Select Emails from the options.

- Click on Payment Reminders.

- Turn on the Automatic Payment Reminders switch.

- Customize the reminder schedule and message content.

- Click Save to apply the changes.

Automated payment reminders reduce the time spent chasing payments. They ensure clients receive timely notifications about their dues, aiding in prompt payment.

Generating Income Reports

Tracking income is vital for any business. FreshBooks makes it easy with its powerful reporting features. Generating income reports helps you understand financial health. It also aids in making informed decisions.

Types Of Reports

FreshBooks offers various report types to track income:

- Profit & Loss Report: Shows total income and expenses over a period.

- Sales Tax Summary: Breaks down sales tax collected and owed.

- Invoice Details: Lists all invoices with their status and payment dates.

Customizing Reports

You can customize reports in FreshBooks to suit your needs. Customize report dates, filters, and data fields. This ensures you get the most relevant information.

Steps to customize a report:

- Go to the Reports section.

- Select the type of report you need.

- Choose the date range.

- Apply any necessary filters.

- Click Generate to view your customized report.

Customizing reports helps focus on specific areas of your business.

Integrating With Other Tools

Integrating FreshBooks with other tools can streamline your income tracking process. It helps in automating tasks and reducing manual errors. This integration ensures that all your financial data is in one place, making it easier to manage.

Connecting Payment Gateways

FreshBooks supports multiple payment gateways. This makes it simple to track income from various sources. To connect a payment gateway:

- Go to the Settings menu.

- Select Payments.

- Choose a gateway like PayPal or Stripe.

- Follow the prompts to connect your account.

Once connected, payments received through these gateways will automatically sync with FreshBooks. This ensures accurate and up-to-date income records.

Syncing With Accounting Software

Syncing FreshBooks with other accounting software can further enhance your financial management. This integration helps in consolidating data from different platforms. To sync with accounting software:

- Navigate to the Apps section in FreshBooks.

- Search for the accounting software you use, like QuickBooks or Xero.

- Click Connect and follow the setup instructions.

Using this integration, you can avoid duplicate entries and ensure that your financial data is consistent across all platforms. This makes it easier to generate comprehensive reports and maintain accurate records.

| Tool | Integration Benefit |

|---|---|

| Payment Gateways | Automated income tracking |

| Accounting Software | Consolidated financial data |

Credit: www.youtube.com

Tips For Effective Income Tracking

Tracking income effectively in FreshBooks is essential for business success. It helps you understand your financial health. Here are some practical tips to ensure accurate and efficient income tracking.

Regular Monitoring

Set aside time each week to review your income. This habit helps you stay on top of your finances. It also helps you spot any discrepancies early.

Use FreshBooks to generate income reports. These reports give you a clear picture of your earnings. Regular monitoring ensures you know where your money is coming from.

Best Practices

Here are some best practices for tracking income in FreshBooks:

- Record Every Payment: Log every payment as soon as you receive it. This prevents missing any income.

- Use Invoicing Tools: FreshBooks‘ invoicing tools help you create and send invoices. Automated invoicing ensures timely payments.

- Categorize Income Sources: Group income by clients or projects. This makes it easier to track and analyze.

- Reconcile Accounts Monthly: Match your FreshBooks records with bank statements. This ensures accuracy and helps identify any errors.

Example Table Of Income Sources

| Client | Project | Amount | Date |

|---|---|---|---|

| Client A | Website Design | $500 | 2023-01-15 |

| Client B | SEO Services | $300 | 2023-01-20 |

Using Freshbooks Tools

FreshBooks offers many tools to help you track income. Use the expense tracking feature to link expenses to income. This shows you the net profit from each project.

Set up automatic reminders for unpaid invoices. This ensures you get paid on time. Use the mobile app to track income on the go.

Troubleshooting Common Issues

Tracking income in FreshBooks can sometimes present challenges. These issues can affect the accuracy of your financial data. Identifying and resolving these problems is crucial for smooth operations. This section will explore common troubleshooting tips for handling discrepancies and accessing customer support.

Handling Discrepancies

Discrepancies in your FreshBooks income data can arise from various sources. Identifying these discrepancies early is key. Here are some common causes and solutions:

- Missing Transactions: Ensure all transactions are entered correctly. Cross-check your bank statements with FreshBooks entries.

- Incorrect Amounts: Verify that the amounts entered match your invoices and receipts.

- Duplicate Entries: Look for and remove any duplicate transactions.

- Date Errors: Ensure the transaction dates are accurate and consistent.

Keeping a clean and organized record helps prevent these issues. Regularly reconciling your accounts can also minimize errors.

Customer Support

Sometimes, troubleshooting might require expert assistance. FreshBooks offers robust customer support to help you resolve issues.

- Contact Options: You can reach FreshBooks support via email, phone, or live chat.

- Help Center: Access the FreshBooks Help Center for guides and FAQs.

- Community Forums: Engage with other users in the FreshBooks community forums for advice and tips.

Don’t hesitate to contact FreshBooks support if you face persistent issues. Their team is equipped to help you maintain accurate financial records.

Frequently Asked Questions

How Do I Record Income In Freshbooks?

To record income in FreshBooks, navigate to the “Invoices” section. Create a new invoice and fill out client details. Add the income details and save.

Can Freshbooks Track Multiple Income Sources?

Yes, FreshBooks allows you to track multiple income sources. You can create separate invoices for each source, ensuring accurate tracking.

Is Freshbooks Good For Income Tracking?

FreshBooks is excellent for income tracking. It offers intuitive features like invoicing, expense tracking, and financial reports to manage your income efficiently.

How Do I Generate Income Reports In Freshbooks?

To generate income reports, go to the “Reports” section. Select the desired report type, like “Profit & Loss,” and view your income details.

Conclusion

Tracking income in FreshBooks is simple and effective. The platform offers user-friendly tools. You can easily monitor your earnings. It helps keep your finances organized. FreshBooks provides clear reports and insights. This aids in better business decisions. Regular tracking ensures accurate financial records.

This keeps your business on the right path. You gain a clear view of your cash flow. Staying on top of your income becomes less stressful. FreshBooks is a helpful tool for any business owner. It simplifies income tracking, making your life easier.