Reconciling in FreshBooks ensures your records match your bank statements. It’s crucial for accurate accounting.

If you’re new to FreshBooks or need a refresher, reconciling might seem daunting. But don’t worry, it’s simpler than it sounds. FreshBooks makes the process straightforward, helping you keep your finances in order. Regular reconciliation helps you catch errors and understand your financial health.

This guide will walk you through the steps, making it easy to reconcile like a pro. Whether you’re a business owner or freelancer, mastering reconciliation in FreshBooks is essential. Let’s dive in and simplify your bookkeeping tasks!

Introduction To Freshbooks Reconciliation

Freshbooks is a popular accounting software. It helps businesses manage finances. One key feature is reconciliation. Reconciliation ensures all transactions are accurate. It matches bank transactions with your Freshbooks records. This step keeps your financial data precise and trustworthy.

Importance Of Reconciliation

Reconciliation is crucial for any business. It helps identify errors. Some errors might be duplicate entries or missed transactions. Fixing these errors saves time. It also prevents future headaches.

Reconciliation ensures your financial statements are correct. Accurate statements are essential for decision-making. They help track your business’s financial health.

Benefits For Your Business

Reconciliation offers many benefits. Here are a few:

- Accuracy: It ensures your records match actual bank transactions.

- Fraud Detection: It helps spot any unauthorized transactions.

- Compliance: It keeps your business compliant with accounting standards.

- Cash Flow Management: It helps track cash inflow and outflow effectively.

By reconciling regularly, you gain a clear view of your finances. This clear view aids in better financial planning.

| Benefit | Description |

|---|---|

| Accuracy | Ensures your records match bank transactions. |

| Fraud Detection | Helps spot unauthorized transactions. |

| Compliance | Keeps you compliant with accounting standards. |

| Cash Flow Management | Tracks cash inflow and outflow effectively. |

Regular reconciliation is a best practice. It ensures your business runs smoothly.

Setting Up Freshbooks For Reconciliation

Reconciling your accounts in Freshbooks is crucial for accurate financial tracking. Setting up Freshbooks properly is the first step. This guide will walk you through the initial setup and connecting your bank accounts for a seamless reconciliation process.

Account Setup

To begin, log in to your Freshbooks account. Navigate to the Settings tab on the dashboard. Here, you can set up your company details. Enter your business name, address, and contact information. This ensures all your invoices and reports are accurate.

Next, go to the Accounting Settings. This is where you can configure your financial preferences. Set your fiscal year, accounting method, and default currency. Having these details set up correctly is essential for proper reconciliation.

Connecting Bank Accounts

Connecting your bank accounts to Freshbooks is the next step. This allows for automatic transaction imports. Go to the Banking section in the dashboard. Click on Add Account.

Select your bank from the list. Enter your bank login details. Freshbooks will securely connect to your bank. Once connected, your transactions will start importing automatically. This makes reconciliation much easier.

You can also set up multiple bank accounts if needed. This is useful if you have separate accounts for business expenses and income. Each account’s transactions will be imported and categorized separately.

| Step | Action |

|---|---|

| 1 | Log in to Freshbooks |

| 2 | Navigate to Settings |

| 3 | Enter Company Details |

| 4 | Configure Accounting Settings |

| 5 | Go to Banking Section |

| 6 | Click Add Account |

| 7 | Select Bank and Enter Login Details |

Ensure to review imported transactions regularly. This keeps your accounts up-to-date and accurate.

Preparing For Reconciliation

Before you start the reconciliation process in FreshBooks, it’s essential to prepare thoroughly. Proper preparation helps ensure accuracy and saves time. Let’s dive into the steps you need to follow to get ready for reconciliation.

Gather Necessary Documents

Begin by gathering all the necessary documents. You’ll need your bank statements, credit card statements, and any other financial records related to your business. Having these documents handy is crucial for cross-referencing transactions.

- Bank statements

- Credit card statements

- Receipts

- Invoices

Make sure these documents cover the same period you are reconciling. This ensures you don’t miss any transactions.

Review Transactions

Next, review all the transactions in FreshBooks. Ensure they match the transactions in your documents. This step helps identify any discrepancies or missing entries.

- Log in to FreshBooks.

- Navigate to the Transactions section.

- Compare each transaction with your statements.

If you find any mismatches, investigate and correct them. Accuracy is key here.

By following these steps, you can ensure your reconciliation process in FreshBooks is smooth and error-free.

Starting The Reconciliation Process

Reconciling your accounts in FreshBooks is crucial for maintaining accurate financial records. This process ensures that your bank statements match your FreshBooks records, helping you identify any discrepancies. Let’s walk through the initial steps of starting the reconciliation process.

Accessing The Reconciliation Tool

First, log in to your FreshBooks account. Once logged in, navigate to the Accounting section. This can be found on the left-hand side of the dashboard. Under the Accounting section, click on Bank Reconciliation.

You’ll now be in the Reconciliation Tool. This is where you’ll manage all your reconciliations. Make sure you have your bank statements handy before proceeding.

Selecting The Account To Reconcile

In the Reconciliation Tool, you’ll see a list of your accounts. Select the account you want to reconcile. This could be your checking account, savings account, or any other account linked to your FreshBooks.

Once you’ve selected the account, click on the Reconcile button. This will take you to a new screen where you can start matching your FreshBooks transactions with your bank statement transactions.

Ensure that the beginning balance and ending balance on FreshBooks match your bank statement. If they don’t, you may need to make adjustments.

Remember, accurate reconciliation is key to financial health. Take your time and ensure every transaction matches perfectly.

Matching Transactions

Reconciling transactions in FreshBooks is essential for accurate financial records. Matching transactions ensures your bank account aligns with your FreshBooks records. This process can be either manual or automatic.

Manual Matching

Manual matching involves comparing your bank statements with your FreshBooks records. Follow these steps:

- Go to the ‘Bank Reconciliation’ section in FreshBooks.

- Select the account you want to reconcile.

- Match each transaction from your bank statement to those in FreshBooks.

- Mark transactions as ‘matched’ once verified.

- Resolve any discrepancies by investigating unmatched transactions.

Manual matching gives you full control over the process. It ensures all transactions are accurate and complete.

Automatic Matching

Automatic matching simplifies the process by using FreshBooks’ smart features. Follow these steps:

- Enable automatic bank feeds in FreshBooks.

- FreshBooks will import your transactions automatically.

- The system will try to match transactions for you.

- Review the suggested matches to ensure accuracy.

- Approve the matched transactions.

Automatic matching saves time and reduces human error. It is ideal for businesses with a high volume of transactions.

Both manual and automatic matching have their benefits. Choose the method that best suits your business needs.

Handling Discrepancies

Reconciling in FreshBooks can sometimes lead to discrepancies. Understanding how to handle these discrepancies is essential for maintaining accurate financial records. This section will guide you through identifying errors and correcting mistakes effectively.

Identifying Errors

Errors can happen during reconciliation. It is crucial to identify them early. Here are some common errors to look for:

- Duplicate Entries: Check for transactions entered more than once.

- Missing Transactions: Ensure all transactions from your bank statement are in FreshBooks.

- Incorrect Amounts: Verify that the amounts match between your bank statement and FreshBooks.

Use the FreshBooks reconciliation report. It helps identify discrepancies quickly.

Correcting Mistakes

Once you identify an error, follow these steps to correct it:

- Duplicate Entries: Delete or merge duplicate transactions.

- Missing Transactions: Manually add any missing transactions to FreshBooks.

- Incorrect Amounts: Edit the transaction to match the correct amount.

After correcting the mistakes, re-run the reconciliation report. Ensure all discrepancies are resolved.

Handling discrepancies in FreshBooks is crucial for accurate accounting. By identifying errors and correcting mistakes, you maintain accurate financial records.

Finalizing Reconciliation

Finalizing reconciliation in FreshBooks is a crucial step for ensuring your financial records are accurate. After matching transactions and identifying any discrepancies, the next stage involves reviewing your work and saving your progress. This process helps maintain the integrity of your financial data and prepares you for future accounting tasks.

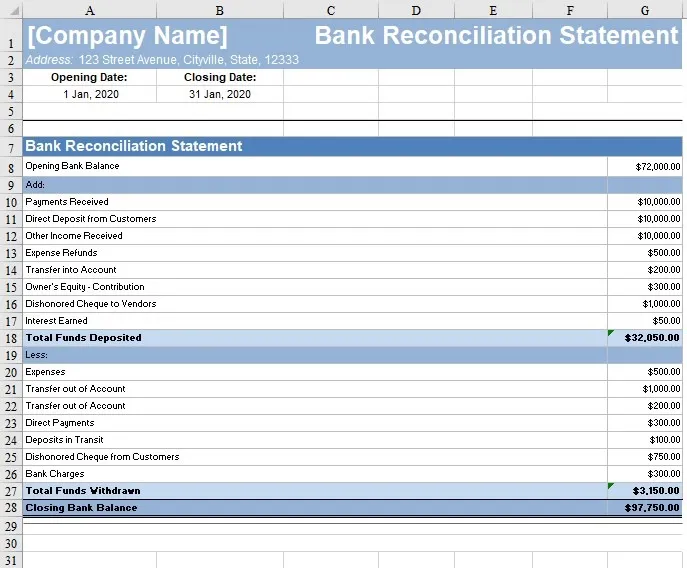

Reviewing The Summary

Once you have matched all transactions, it’s important to review the summary of your reconciliation. FreshBooks provides a detailed summary that includes:

- Beginning balance

- Ending balance

- Total debits

- Total credits

- Any discrepancies

Check each section carefully. Ensure that the beginning balance matches your bank statement. Verify that the ending balance is correct. Look for any discrepancies and investigate their causes. This step is essential to confirm that all transactions have been accurately recorded.

Saving Your Work

After reviewing the summary, the next step is saving your work. FreshBooks allows you to save your reconciliation progress. This ensures that all the matched transactions and changes are securely stored.

To save your work:

- Click the “Save” button at the bottom of the reconciliation page.

- Confirm that all transactions are correctly matched and no discrepancies are left unresolved.

- Make sure the saved data reflects the accurate financial status of your business.

Saving your work regularly prevents data loss and keeps your financial records up-to-date. It also makes it easier to continue the reconciliation process at a later time without losing any progress.

By thoroughly reviewing the summary and saving your work, you can finalize your reconciliation in FreshBooks effectively. This will help maintain accurate financial records and support your business’s overall financial health.

Credit: www.freshbooks.com

Post-reconciliation Tasks

After reconciling your accounts in FreshBooks, it’s important to carry out some post-reconciliation tasks. These tasks ensure your records are accurate and up-to-date. They also help you to better understand your financial position. Below, we explore two key post-reconciliation tasks: generating reports and maintaining records.

Generating Reports

Once reconciliation is complete, generating reports is crucial. Reports provide a snapshot of your financial health. In FreshBooks, you can generate various reports:

- Profit and Loss Report: Shows your income and expenses over a period.

- Balance Sheet: Summarizes your assets, liabilities, and equity.

- Cash Flow Report: Tracks the flow of cash in and out of your business.

To generate a report in FreshBooks, follow these steps:

- Go to the Reports section.

- Select the type of report you need.

- Set the date range and other parameters.

- Click Generate to view your report.

Reviewing these reports helps in making informed business decisions.

Maintaining Records

Maintaining records is another essential task. Proper record-keeping ensures you have an audit trail. This is especially important during tax season.

Here are some tips for maintaining records in FreshBooks:

- Organize your receipts and invoices.

- Regularly update your records.

- Use FreshBooks’ cloud storage for backups.

Following these tips helps in keeping your financial information secure and accessible.

In summary, post-reconciliation tasks in FreshBooks are vital. They help you understand your financial health and maintain accurate records.

Tips For Smooth Reconciliation

Reconciliation in FreshBooks can be a smooth process with a few tips. Regular reconciliation and utilizing FreshBooks features can streamline your workflow. Below are some tips to help you manage your accounts more effectively.

Regular Reconciliation

Regular reconciliation helps you keep your accounts up to date. Set a schedule to review your accounts weekly. This practice prevents small issues from becoming big problems. It also ensures you catch errors early.

- Compare your bank statements with your FreshBooks records.

- Check for any discrepancies and resolve them promptly.

- Ensure all transactions are recorded correctly.

Consistent reconciliation builds a reliable financial record. It also simplifies tax preparation and financial reporting.

Utilizing Freshbooks Features

FreshBooks offers several features to aid reconciliation. These tools can save time and reduce errors.

| Feature | Benefit |

|---|---|

| Bank Connection | Automatically import transactions from your bank. |

| Expense Tracking | Keep a record of all your expenses. |

| Reports | Generate detailed financial reports with a click. |

Bank Connection: This feature links your bank account to FreshBooks. It automatically imports transactions, saving you time. You can then match these transactions with your records easily.

Expense Tracking: Use this feature to record every expense. Categorize them properly to simplify reconciliation. This ensures you don’t miss any expenses.

Reports: FreshBooks can generate detailed reports. Use these reports to review your financial status. They can help you identify discrepancies and track your financial health.

Utilizing these features can make reconciliation more efficient. Embrace these tools to maintain accurate and up-to-date records.

Credit: www.freshbooks.com

Credit: www.youtube.com

Frequently Asked Questions

How Do I Start Reconciliation In Freshbooks?

To start reconciliation in Freshbooks, go to the ‘Accounting’ tab. Select ‘Reconcile’ from the dropdown menu. Follow the on-screen prompts to begin.

What Is The Purpose Of Reconciliation?

Reconciliation ensures your Freshbooks records match your bank statements. It helps identify discrepancies and maintains accurate financial records.

How Often Should I Reconcile My Accounts?

It’s best to reconcile your accounts monthly. Regular reconciliation helps maintain accurate financial records and catch errors early.

Can I Reconcile Multiple Accounts In Freshbooks?

Yes, you can reconcile multiple accounts in Freshbooks. Select each account from the ‘Accounting’ tab and follow the reconciliation steps.

Conclusion

Reconciling in FreshBooks can simplify your accounting tasks. Follow the steps shared to ensure accuracy. Regular reconciliation helps catch errors and maintain financial health. FreshBooks offers tools to ease this process. Stay consistent and organized with your reconciliations. This practice saves time and avoids future headaches.

Remember, a clear financial picture supports better business decisions. Start reconciling today to keep your finances in check. Happy accounting!