Yes, Freshbooks does integrate with Quickbooks. This integration allows users to sync their financial data between both platforms seamlessly.

Small business owners and freelancers often juggle multiple tasks. Managing finances is crucial but can be overwhelming. Freshbooks and Quickbooks are two popular accounting software options. Knowing they can work together simplifies life. Integrating these tools means data flows smoothly, reducing manual entry and errors.

This blog will explore how Freshbooks and Quickbooks integrate, the benefits, and steps to set it up. This integration can save you time and enhance your financial management process. Let’s dive in and see how these tools can work in harmony.

Freshbooks And Quickbooks Integration

Businesses need efficient accounting software. Freshbooks and Quickbooks are popular choices. Integrating these two can simplify financial management. This section explores the integration process and its benefits.

Introduction To Integration

Freshbooks and Quickbooks can integrate seamlessly. This integration allows data to flow between the two platforms. Users can sync invoices, expenses, and client information. This reduces manual data entry and minimizes errors.

Benefits Of Integration

Integrating Freshbooks with Quickbooks offers several advantages:

- Time-Saving: Automate data transfer between platforms.

- Accuracy: Reduce human errors with automatic syncing.

- Efficiency: Streamline financial tasks and improve productivity.

- Comprehensive Reports: Access detailed financial reports easily.

Below is a table summarizing the key benefits:

| Benefit | Description |

|---|---|

| Time-Saving | Automate data transfer between platforms. |

| Accuracy | Reduce human errors with automatic syncing. |

| Efficiency | Streamline financial tasks and improve productivity. |

| Comprehensive Reports | Access detailed financial reports easily. |

The integration of Freshbooks and Quickbooks is straightforward. Follow the prompts within the software to connect them. Enjoy a more efficient accounting process with this integration.

Credit: quickbooks.intuit.com

Key Features Of Freshbooks

Freshbooks is known for its user-friendly interface and comprehensive features. It is a popular choice for many small businesses and freelancers. In this section, we will explore the key features of Freshbooks, focusing on its invoicing capabilities and expense tracking.

Invoicing Capabilities

Freshbooks offers robust invoicing capabilities to simplify billing for your business. You can create and send professional invoices in minutes. The platform allows customization of invoices with your logo and colors. You can also set up recurring invoices and automate payment reminders.

The invoicing system supports multiple currencies and languages. This feature is crucial for businesses with international clients. Freshbooks also enables online payments, making it easier for clients to pay you. The platform integrates with payment gateways like PayPal and Stripe.

- Create and send professional invoices

- Customize invoices with logo and colors

- Set up recurring invoices

- Automate payment reminders

- Supports multiple currencies and languages

- Enables online payments

Expense Tracking

Effective expense tracking is vital for managing your finances. Freshbooks simplifies this process with its intuitive features. You can easily record and categorize expenses. The platform allows you to attach receipts to each expense, ensuring accurate records.

Freshbooks offers bank connection, enabling automatic import of transactions. This feature saves time and reduces manual entry errors. You can also generate expense reports to understand your spending patterns. These reports help in making informed financial decisions.

| Feature | Description |

|---|---|

| Record and categorize expenses | Organize expenses for better management |

| Attach receipts | Ensure accurate expense records |

| Bank connection | Automatic import of transactions |

| Generate expense reports | Analyze spending patterns |

Key Features Of Quickbooks

QuickBooks is a popular accounting software known for its robust features. It helps small businesses manage their finances efficiently. Below are some key features that make QuickBooks a go-to choice for many.

Financial Reporting

QuickBooks offers comprehensive financial reporting tools. Users can easily generate reports like profit and loss statements, balance sheets, and cash flow statements.

- Profit and Loss Statements: Understand your revenue and expenses.

- Balance Sheets: Get a snapshot of your financial health.

- Cash Flow Statements: Monitor your cash inflows and outflows.

These reports can be customized to fit specific business needs. QuickBooks also allows exporting reports to Excel for further analysis.

Payroll Management

QuickBooks simplifies payroll management for businesses. It automates payroll processing, ensuring employees are paid on time.

- Automated Payroll: Set up and automate payroll schedules.

- Tax Calculations: QuickBooks handles tax calculations and deductions.

- Direct Deposit: Pay employees via direct deposit, reducing paperwork.

QuickBooks also takes care of payroll tax filings, making compliance easy. This feature saves time and reduces the risk of errors.

Integration Process

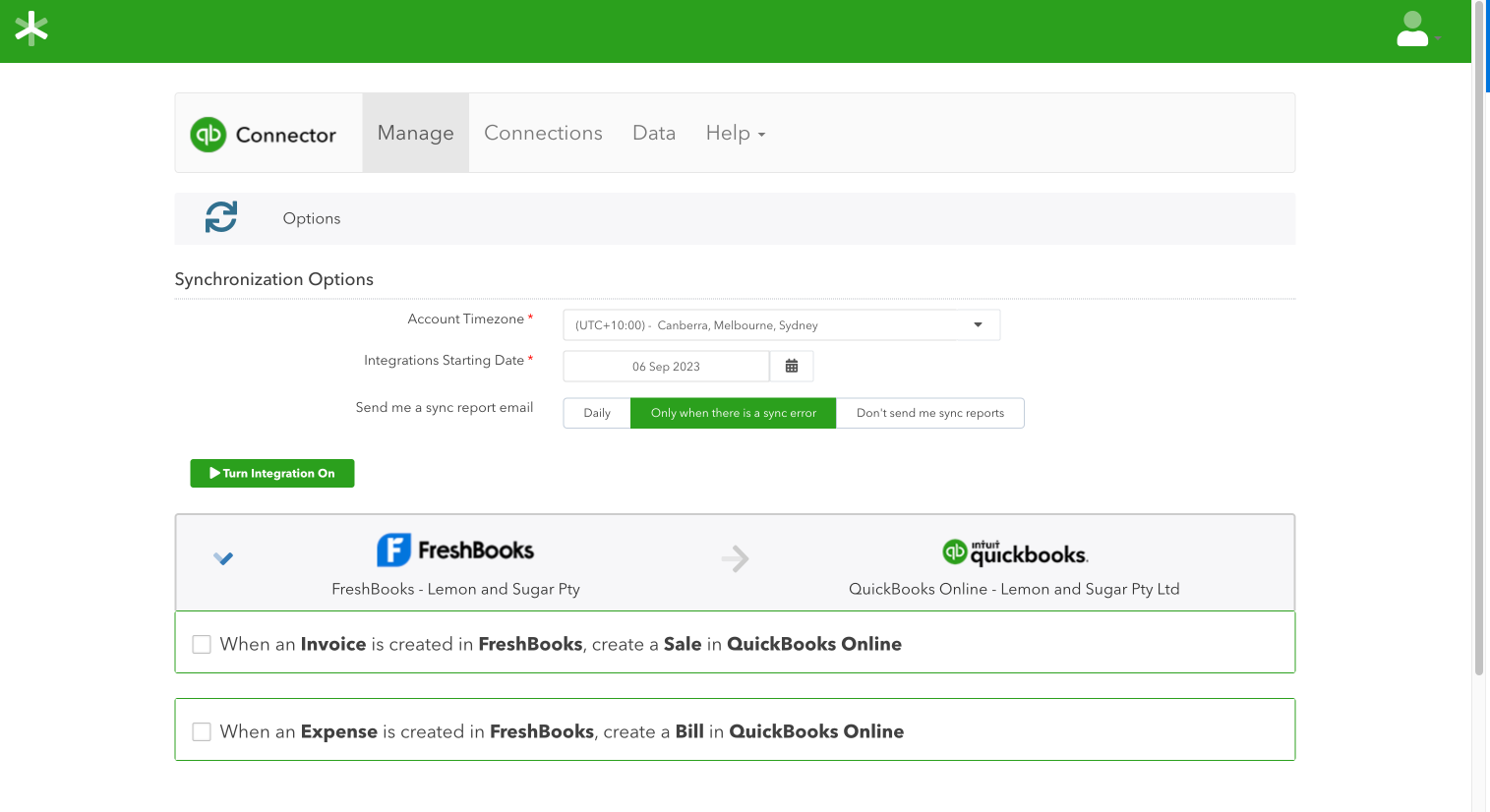

Integrating FreshBooks with QuickBooks can streamline your accounting processes. It allows you to transfer data between platforms seamlessly. This integration saves time and reduces errors.

Setup Steps

- Sign in to your FreshBooks account.

- Go to the Integrations section in the dashboard.

- Find QuickBooks in the list of available integrations.

- Click on the Connect button next to QuickBooks.

- Sign in to your QuickBooks account when prompted.

- Authorize FreshBooks to access your QuickBooks data.

- Choose the data you want to sync between the two platforms.

- Review the settings and confirm the integration.

Required Tools

| Tool | Description |

|---|---|

| FreshBooks Account | A registered account on FreshBooks to initiate the integration. |

| QuickBooks Account | A registered account on QuickBooks to complete the connection. |

| Internet Connection | A stable internet connection for accessing both platforms. |

Follow these steps carefully to integrate FreshBooks with QuickBooks. The right tools and a good internet connection are essential. This will ensure a smooth and efficient integration process.

Data Synchronization

Integrating Freshbooks with QuickBooks can streamline your accounting processes. One significant benefit of this integration is data synchronization. Let’s explore how data synchronization between Freshbooks and QuickBooks ensures smooth financial management.

Real-time Updates

With Freshbooks integrating with QuickBooks, you get real-time updates. This means any changes in one system reflect immediately in the other. For example, if you create an invoice in Freshbooks, it will automatically update in QuickBooks. This reduces the need for manual data entry and helps maintain current records.

Data Accuracy

The integration also ensures data accuracy. Errors can occur with manual data entry, leading to discrepancies in your financial records. By synchronizing data between Freshbooks and QuickBooks, you minimize these errors. This ensures your financial data remains accurate and consistent across both platforms.

| Feature | Benefit |

|---|---|

| Real-Time Updates | Immediate reflection of changes across systems |

| Data Accuracy | Minimizes manual entry errors |

- Real-time updates ensure your data is always current.

- Data accuracy eliminates discrepancies and errors.

Synchronizing data between Freshbooks and QuickBooks optimizes your financial management. It saves time and reduces the risk of errors. This integration is a valuable tool for any business looking to streamline their accounting processes.

Common Issues And Solutions

FreshBooks and QuickBooks are popular accounting tools. Integrating them can streamline your business operations. But, users face some common issues. Here, we address these problems and offer practical solutions.

Error Troubleshooting

Users often face errors during integration. Common errors include data sync problems, missing transactions, and login issues.

| Error | Cause | Solution |

|---|---|---|

| Data Sync Problems | Network issues or incorrect settings | Check network and settings, then re-sync |

| Missing Transactions | Incomplete data entry | Ensure all data is entered correctly |

| Login Issues | Incorrect credentials | Verify login details and try again |

Customer Support

Both FreshBooks and QuickBooks offer customer support. This can help resolve integration issues quickly.

Here are ways to get support:

- Visit the FreshBooks support page

- Visit the QuickBooks support page

- Use live chat for real-time help

- Call the support hotline for urgent issues

For complex issues, consider hiring a professional. This ensures your integration works smoothly.

Case Studies

Understanding how FreshBooks integrates with QuickBooks can greatly benefit businesses of all sizes. Real-world examples show how this integration helps various professionals. The following case studies illustrate the practical advantages of using both platforms together.

Small Business Success

Many small businesses find the integration between FreshBooks and QuickBooks invaluable. Take, for instance, a local bakery. The bakery uses FreshBooks for invoicing and QuickBooks for accounting. The seamless connection between the two platforms means no more manual data entry.

This integration saves time and reduces errors. The bakery owner can now focus on creating delicious products instead of worrying about financial records.

Another example is a small marketing firm. With FreshBooks, they track billable hours and send invoices. QuickBooks handles payroll and tax filing. The integration ensures all financial data is always up-to-date.

Small businesses benefit from this streamlined process. It leads to better financial management and less stress.

Freelancer Benefits

Freelancers also enjoy the advantages of integrating FreshBooks with QuickBooks. Consider a freelance graphic designer. They use FreshBooks to manage client invoices and project tracking.

QuickBooks takes care of their expense tracking and tax preparation. The integration makes it easy to sync all financial information. This helps the freelancer stay organized and avoid late payments.

Another example is a freelance writer. FreshBooks helps them track hours worked and send professional invoices. QuickBooks handles the business side, like expense reports and financial planning.

This integration allows freelancers to manage their finances more efficiently. It frees up time to focus on their creative work.

Overall, integrating FreshBooks with QuickBooks offers many benefits. Both small businesses and freelancers can see significant improvements in their financial processes.

Credit: quickbooks.intuit.com

Credit: www.freshbooks.com

Frequently Asked Questions

Does Freshbooks Integrate With Quickbooks?

Yes, FreshBooks integrates with QuickBooks via third-party apps. This integration helps streamline financial management tasks.

How Do I Connect Freshbooks To Quickbooks?

To connect FreshBooks to QuickBooks, use a third-party app like Zapier. Follow the app’s instructions for seamless integration.

Can I Transfer Data Between Freshbooks And Quickbooks?

Yes, you can transfer data between FreshBooks and QuickBooks. Use third-party tools to ensure a smooth data migration process.

Is Freshbooks Compatible With Quickbooks Online?

FreshBooks is compatible with QuickBooks Online. Use integration tools to connect both platforms for efficient financial management.

Conclusion

FreshBooks and QuickBooks integration offers many benefits. It simplifies your accounting tasks. You can manage finances more efficiently. Both platforms provide a smooth user experience. Connecting them saves you time and effort. This integration can streamline your business operations. You gain better control over financial data.

It helps in making informed decisions. So, integrating FreshBooks with QuickBooks is worth considering. It enhances productivity and keeps your finances organized.