FreshBooks simplifies accounting for small businesses and freelancers. It’s user-friendly and efficient.

Handling finances can feel overwhelming, especially if you lack an accounting background. FreshBooks offers a solution. Designed with simplicity in mind, it helps you manage invoices, track expenses, and stay on top of your finances. Whether you’re sending invoices, capturing expenses, or monitoring your cash flow, FreshBooks makes these tasks straightforward.

By using FreshBooks, you can save time and reduce the stress of managing your accounts. This guide will show you how to use FreshBooks for accounting, ensuring you make the most of its features. Ready to streamline your accounting processes? Let’s dive in.

Credit: www.freshbooks.com

Introduction To Freshbooks

Freshbooks is a powerful tool for small business owners. It makes accounting simple and efficient. Many business owners find accounting complex and time-consuming. Freshbooks aims to change that. Let’s explore what makes Freshbooks special.

What Is Freshbooks?

Freshbooks is a cloud-based accounting software. It is designed for small businesses and freelancers. With Freshbooks, you can manage invoices, expenses, and time tracking. It also handles project management and reports. Everything is in one place, making it very convenient.

Benefits Of Using Freshbooks

Freshbooks offers many benefits. Here are some key advantages:

- User-friendly Interface: Freshbooks is easy to navigate. You don’t need to be an expert to use it.

- Automated Invoicing: Save time with automated invoicing. Freshbooks sends invoices and reminders for you.

- Expense Tracking: Keep track of all your expenses. Freshbooks helps you stay organized.

- Time Tracking: Track your time effortlessly. This feature is great for freelancers.

- Project Management: Manage your projects in one place. Assign tasks and track progress easily.

- Reports and Insights: Generate financial reports. Understand your business performance better.

| Feature | Description |

|---|---|

| Invoicing | Automated invoicing, reminders, and payment tracking. |

| Expense Tracking | Organize and categorize expenses easily. |

| Time Tracking | Track billable hours for clients. |

| Project Management | Assign tasks and track project progress. |

| Reports | Generate detailed financial reports. |

Freshbooks is an excellent tool for small businesses. It simplifies accounting tasks and saves time. Try Freshbooks to see how it can help your business.

Credit: www.youtube.com

Setting Up Your Account

Setting up your FreshBooks account is the first step to managing your finances. This process ensures your account is tailored to your business needs. Follow these simple steps to get started.

Creating An Account

To begin, you need to create a FreshBooks account. Follow these steps:

- Go to the FreshBooks website.

- Click on the Sign Up button.

- Enter your email address and create a password.

- Fill in your business information and click Create Account.

After creating your account, you will receive a confirmation email. Verify your email to access your FreshBooks dashboard.

Configuring Basic Settings

Once your account is set up, configure the basic settings to customize your experience. Follow these steps:

- Company Profile: Go to Settings and click on Company Profile. Enter your business name, logo, and contact information.

- Currency and Language: Under Settings, select Currency and Language to match your business needs.

- Business Hours: Set your business hours in the Settings section. This helps keep track of your working time.

Configuring these basic settings ensures that your FreshBooks account is ready for use. It helps streamline your accounting process and ensures accurate records.

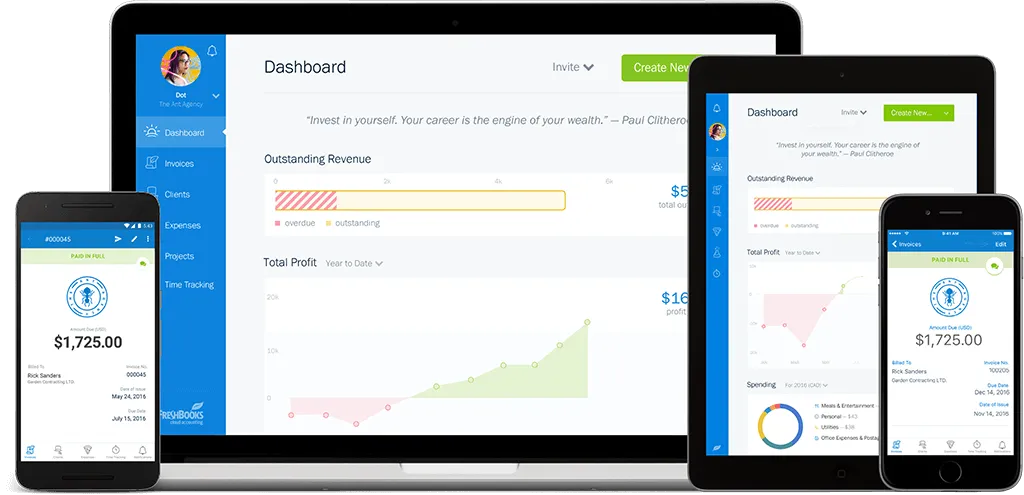

Navigating The Dashboard

Navigating the Freshbooks dashboard is a crucial step for effective accounting. The dashboard provides an overview of your business finances and helps you manage them efficiently. In this section, we will explore the key features of the Freshbooks dashboard and how you can customize it to meet your needs.

Main Features Overview

The Freshbooks dashboard offers several main features to help you stay on top of your finances:

- Income and Expenses: View your recent income and expenses at a glance.

- Outstanding Invoices: See which invoices are still unpaid.

- Profit and Loss: Track your profit and loss over a specific period.

- Recent Activity: Monitor recent transactions and activities.

- Client Overview: Get insights into your clients and their statuses.

These features provide a comprehensive snapshot of your business’s financial health. They help you make informed decisions quickly.

Customizing Your Dashboard

Customizing your Freshbooks dashboard allows you to tailor it to your specific needs. Follow these steps to personalize your dashboard:

- Access Settings: Click on the settings icon in the top right corner.

- Select Widgets: Choose which widgets you want to display on your dashboard.

- Rearrange Widgets: Drag and drop widgets to arrange them in your preferred order.

- Save Changes: Save your changes to update your dashboard layout.

By customizing your dashboard, you can focus on the most important aspects of your business. This helps you stay organized and efficient.

| Feature | Description |

|---|---|

| Income and Expenses | Monitor your recent income and expenses. |

| Outstanding Invoices | View unpaid invoices and follow up with clients. |

| Profit and Loss | Analyze your profit and loss over time. |

| Recent Activity | Track recent transactions and activities. |

| Client Overview | Get insights into your clients’ statuses. |

Invoicing Made Easy

Keeping track of invoices can be a daunting task for many businesses. FreshBooks simplifies this process, making invoicing easier and more efficient. Whether you’re a freelancer or a small business owner, FreshBooks streamlines your invoicing tasks. This ensures you get paid faster and with less hassle.

Creating Invoices

Creating invoices with FreshBooks is straightforward. Follow these simple steps:

- Log in to your FreshBooks account.

- Navigate to the “Invoices” tab on the dashboard.

- Click on the “Create New Invoice” button.

Fill in the necessary details:

- Client Information: Name, email, and address.

- Invoice Date: The date you are creating the invoice.

- Due Date: The date by which payment is expected.

- Item Details: Description, quantity, and price of the services or products.

Once you have filled out all the fields, you can preview the invoice. If everything looks good, click “Send” to deliver it to your client. FreshBooks also allows you to customize your invoices with your logo and color scheme.

Automating Invoices

Automating invoices can save you time and reduce errors. FreshBooks offers several automation features:

- Recurring Invoices: Set up invoices that automatically generate and send at regular intervals.

- Late Payment Reminders: FreshBooks can automatically send reminders for overdue invoices.

- Auto-Billing: Automatically charge clients for recurring services using their saved payment information.

To set up a recurring invoice:

- Go to the “Invoices” tab.

- Click on the “Recurring Templates” option.

- Create a new template by filling out the required fields just like a regular invoice.

Select the frequency (e.g., weekly, monthly) and the start date. Your invoices will now be sent automatically based on the schedule you set.

| Feature | Description |

|---|---|

| Recurring Invoices | Automatically send invoices at set intervals. |

| Late Payment Reminders | Send reminders to clients for overdue payments. |

| Auto-Billing | Charge clients automatically for recurring services. |

FreshBooks makes invoicing easy and efficient. By automating your invoices, you can focus on growing your business instead of managing paperwork.

Expense Tracking

Expense tracking is a crucial part of accounting. It helps you manage your finances. FreshBooks is a tool that simplifies this process. Let’s dive into how to use FreshBooks for expense tracking.

Recording Expenses

Recording expenses in FreshBooks is simple. Follow these steps:

- Log in to your FreshBooks account.

- Click on the “Expenses” tab on the left menu.

- Click on the “New Expense” button.

- Fill in the necessary details such as the amount, date, and vendor.

- Attach a receipt if you have one.

- Click “Save” to record the expense.

Keeping records of all your expenses ensures accuracy. It helps during audits and tax season.

Categorizing Expenses

Categorizing expenses makes financial analysis easier. FreshBooks offers default categories:

- Office Supplies

- Meals and Entertainment

- Travel

- Utilities

You can also create custom categories. Follow these steps:

- Go to the “Expenses” tab.

- Select an expense you want to categorize.

- Click on the category dropdown menu.

- Choose an existing category or create a new one.

- Click “Save” to update the category.

Proper categorization helps you understand your spending habits. It also makes tax filing easier.

FreshBooks makes expense tracking simple and efficient. With these steps, managing your finances becomes easier.

Managing Clients And Projects

Managing clients and projects is crucial for any business. FreshBooks offers tools to help you stay organized and efficient. You can easily add new clients and track project progress. This guide will walk you through these features.

Adding New Clients

Adding new clients in FreshBooks is simple. Follow these steps:

- Log in to your FreshBooks account.

- Navigate to the “Clients” tab.

- Click on the “New Client” button.

- Enter the client’s details. This includes name, email, and address.

- Click “Save” to add the client to your list.

Once added, you can manage client details easily. Update information as needed to keep records accurate.

Tracking Project Progress

Tracking project progress ensures timely completion. FreshBooks offers several features for this:

- Project Overview: View all projects in one place.

- Task Management: Assign tasks to team members.

- Time Tracking: Log hours spent on each task.

- Milestones: Set and monitor key milestones.

To track a project:

- Go to the “Projects” tab.

- Select the project you want to track.

- Update task statuses and log time.

- Review the project’s progress using the dashboard.

These steps help you stay on top of your projects. Ensure you meet deadlines and deliver quality work.

Reporting And Analytics

Understanding your business’s financial health is crucial. Freshbooks makes this easy through its robust reporting and analytics features. Whether you need to generate a report for an investor meeting or analyze your financial data for better decision-making, Freshbooks has got you covered.

Generating Reports

Freshbooks offers a variety of reports to help you stay on top of your finances. With just a few clicks, you can create detailed reports that provide insights into your business’s performance.

- Profit and Loss Report: Shows your total income and expenses over a specific period.

- Expense Report: Breaks down your expenses into categories.

- Invoice Details Report: Lists all your invoices and their statuses.

- Tax Summary Report: Summarizes the taxes you’ve collected and paid.

These reports can be customized to meet your specific needs. You can choose the time period, categories, and other filters. This allows you to focus on the most relevant data.

Analyzing Financial Data

Once you’ve generated your reports, it’s time to analyze the data. Freshbooks provides tools to help you make sense of the numbers.

- Visual Charts: Freshbooks presents data in easy-to-understand charts and graphs. This helps you see trends at a glance.

- Comparative Analysis: Compare different time periods to understand your business growth. See which months were more profitable and why.

- Identify Patterns: Spot patterns in your expenses and revenues. This can help you plan better and cut unnecessary costs.

- Custom Insights: Freshbooks allows you to add notes and tags to your data. This lets you create custom insights tailored to your business.

With these tools, you can make informed decisions. You’ll understand where your money is going and how to improve your financial health.

Using Freshbooks for reporting and analytics simplifies accounting. It provides all the tools you need to manage your finances efficiently.

Integrations And Add-ons

FreshBooks is a powerful tool for accounting, but its real strength lies in its integrations and add-ons. These features allow users to tailor FreshBooks to their specific business needs. By integrating with other software and using add-ons, businesses can enhance FreshBooks’ functionality, making it an even more valuable resource.

Popular Integrations

FreshBooks integrates with many popular apps and services. These integrations help streamline your accounting process. Below are some of the most commonly used integrations:

- PayPal: Easily handle payments and manage transactions.

- Stripe: Accept credit card payments directly through FreshBooks.

- G Suite: Sync your Google Calendar and contacts.

- Shopify: Connect your online store and track sales data.

- Slack: Get updates and notifications in your team channels.

These integrations save time and reduce errors. They help you keep all your financial data in one place.

Using Add-ons For Enhanced Functionality

Add-ons are extra tools that work with FreshBooks to give you more features. Here are some useful add-ons:

- Project Management: Tools like Asana and Trello help manage projects and tasks.

- Time Tracking: Apps like TSheets and Harvest track time spent on tasks.

- Expense Management: Expensify and Receipt Bank automate expense tracking and reporting.

- CRM Systems: Salesforce and HubSpot help you manage customer relationships.

- Inventory Management: Tools like TradeGecko and Stitch Labs track inventory.

Using these add-ons can greatly enhance your FreshBooks experience. They provide additional functionality to meet your business needs.

In summary, FreshBooks’ integrations and add-ons allow you to customize your accounting software. This makes it more efficient and tailored to your business operations.

Tips And Best Practices

Freshbooks can make your accounting tasks much easier. To get the most out of it, follow these tips and best practices. You will improve your efficiency and maximize Freshbooks features.

Improving Efficiency

Efficiency is key in accounting. Here are some tips to help you:

- Automate Invoices: Set up automatic invoices for regular clients. This saves time and ensures consistency.

- Use Recurring Payments: Schedule recurring payments for routine expenses. This helps avoid late fees.

- Link Your Bank Account: Connect your bank account for easy tracking. This keeps your records up-to-date.

- Use Templates: Create templates for frequently used documents. This speeds up the process and maintains uniformity.

Maximizing Freshbooks Features

Freshbooks offers many features. Make sure to use them all:

- Expense Tracking: Capture all your expenses. Use the mobile app to scan receipts on the go.

- Time Tracking: Log your work hours accurately. This is useful for billing clients by the hour.

- Project Management: Use the project management feature. It helps you keep track of tasks and deadlines.

- Reports: Generate reports regularly. This gives you insights into your financial health.

- Client Portal: Give clients access to their own portal. They can view invoices and make payments easily.

By following these tips, you can make the most of Freshbooks. This will help you manage your accounting tasks more effectively.

Credit: www.youtube.com

Frequently Asked Questions

What Is Freshbooks Used For?

FreshBooks is used for accounting and invoicing. It helps small businesses manage finances, track expenses, and send invoices.

How Do I Set Up Freshbooks?

Setting up FreshBooks involves creating an account, adding your business details, and linking your bank accounts.

Is Freshbooks Suitable For Small Businesses?

Yes, FreshBooks is ideal for small businesses. It offers user-friendly features for managing invoices, expenses, and financial reports.

Can Freshbooks Track Expenses?

Yes, FreshBooks can track expenses. You can easily record and categorize your expenses within the platform.

Conclusion

Using FreshBooks for accounting simplifies your financial tasks. It offers user-friendly tools. Even beginners can navigate it easily. You can track expenses, create invoices, and manage clients. The platform’s features help you stay organized. This saves time and reduces stress.

Explore FreshBooks to streamline your accounting process. It’s an effective solution for small businesses. Give it a try and see the benefits. Happy accounting!